What Roles Is AI Playing in Customer Service Interactions?

When we talk about AI handling customer interactions, we’re very often not talking about a single use case. In practice, AI is being deployed across multiple points in the customer journey; taking on a range of clearly defined functions rather than acting as a catch-all replacement for human agents.

Some of these roles are already well established. Others are becoming more prominent as platforms mature and businesses gain confidence in automation.

Initial Support

AI is most commonly used as the initial point of contact. This includes answering FAQs, guiding users through basic troubleshooting, and helping customers navigate menus or self-service portals. By handling high-volume, low-complexity queries, AI reduces queue times and frees up human agents for more complex issues.

Intent Detection & Routing

Beyond answering questions directly, AI plays a critical role behind the scenes. Natural language processing allows systems to understand why a customer is getting in touch and route them to the right department, channel, or agent. In many cases, this happens before a human ever sees the interaction, improving first-contact resolution rates.

Transactional Support

AI is increasingly trusted with transactional tasks. This includes changing account details, processing refunds, tracking orders, resetting passwords, or managing subscriptions. These interactions are structured, repeatable, and ideal for automation, especially at scale.

Proactive Engagement

Rather than waiting for customers to get in touch, AI is now used to initiate interactions. This might involve sending delivery updates, flagging potential service issues, or prompting customers when an action is required. Proactive engagement reduces inbound contact volumes while improving the overall customer experience.

Agent Assistance

Not all AI-handled interactions are customer-facing. AI is also embedded within contact centre workflows to support human agents. This includes real-time response suggestions, knowledge base surfacing, call summarisation, and post-interaction analytics. In these cases, AI improves efficiency without removing the human element.

Personalisation at Scale

AI enables platforms to tailor interactions based on customer history, behaviour, and preferences. This allows businesses to deliver more relevant responses and recommendations without increasing agent workloads, something that becomes increasingly important as interaction volumes grow.

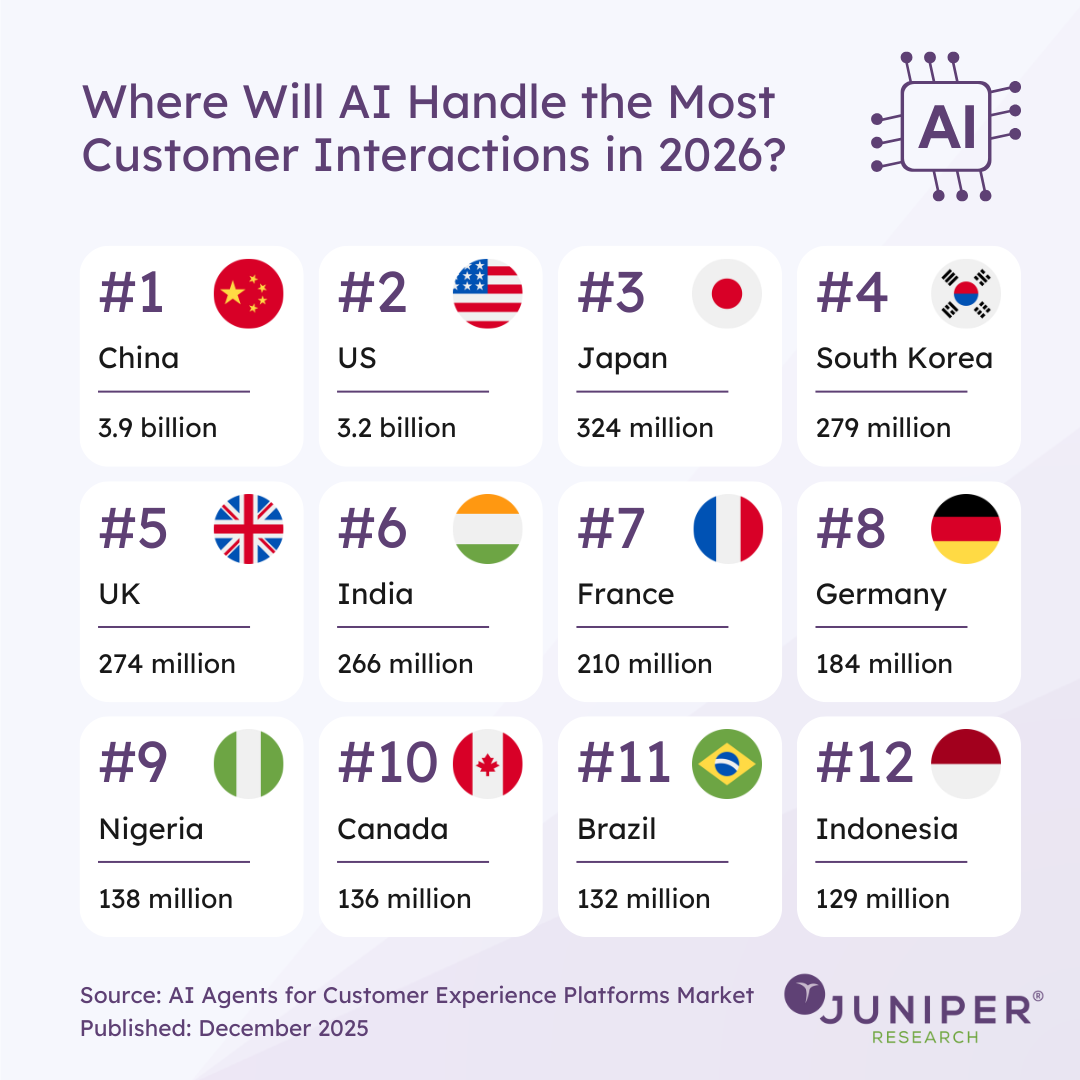

As our latest research demonstrates, the number of AI-handled customer interactions is set to rise sharply across multiple markets in 2026. The key takeaway isn’t just who is adopting AI fastest, but how strategically it’s being deployed. The most effective implementations focus on clearly defined roles for AI, using it to augment customer experience rather than simply automate it.

Source: AI Agents for Customer Experience Platforms Market 2025-2030

Read the Press Release: AI Agents to Power 1,000% More Customer Interactions for Enterprises Globally by 2027

Download the Whitepaper: Human + AI: Drivers of Customer Experience AI Agents in 2026

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026 -

Telecoms & Connectivity

AI Agent Spend for Customer Experience to Grow 400% Globally Over Next Two Years

February 2026 -

Fintech & Payments

Fraudulent eCommerce Transactions to Surpass $131 Billion by 2030 Globally; Driven by Escalating Friendly Fraud

February 2026