SMS, RBM & OTT: Comparing the Messaging Channels for 2025

The business messaging landscape is becoming increasingly diverse, with SMS, Rich Business Messaging (RBM), and Over-the-Top (OTT) channels all vying for attention. Each has its own strengths and limitations, making it vital for enterprises to understand how they compare across reach, features, and security.

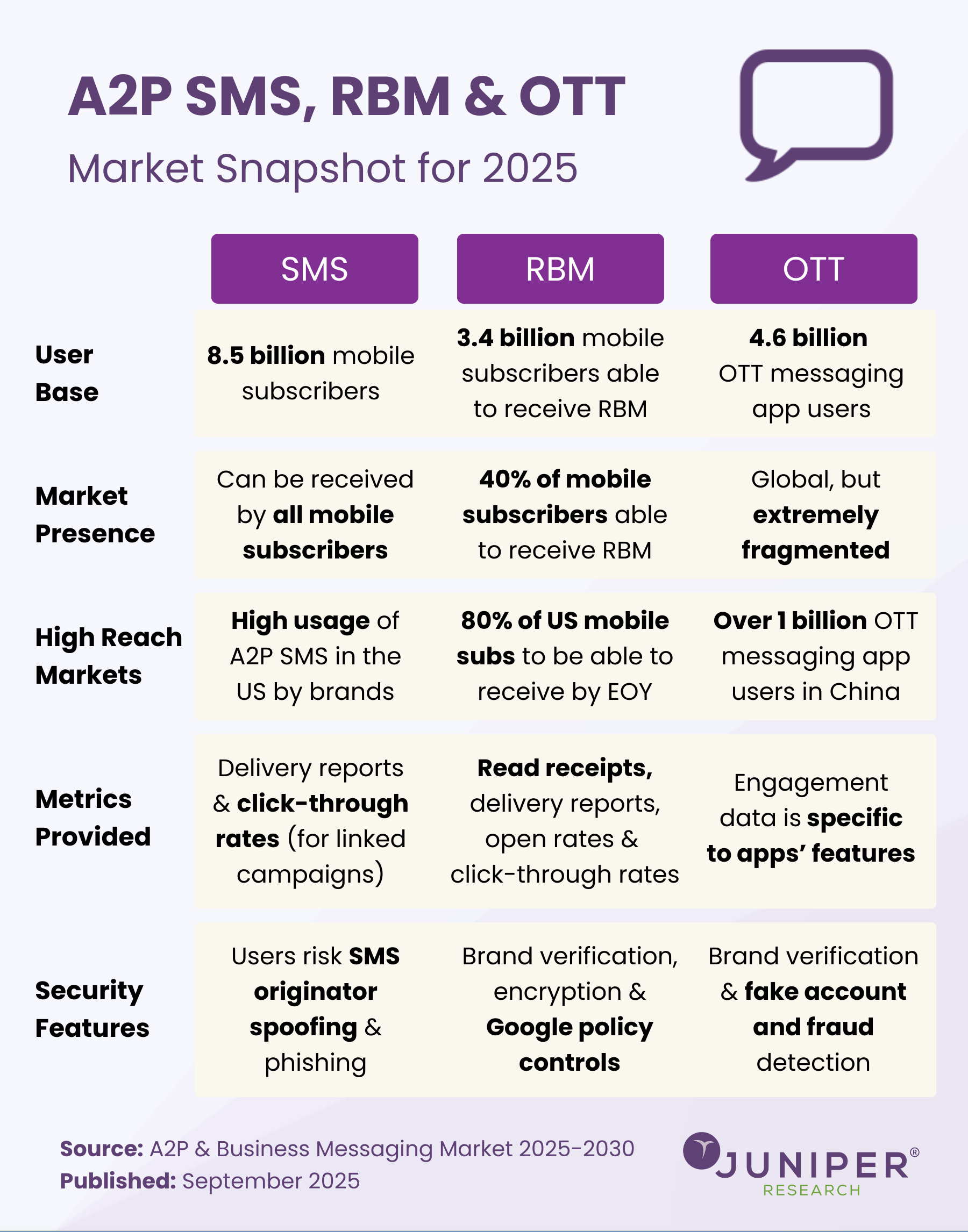

User Base

SMS continues to dominate in sheer scale, with a projected 8.5 billion mobile subscribers worldwide able to receive messages. This makes it the most universal channel, accessible regardless of handset type or app usage.

RBM, by contrast, will reach 3.4 billion subscribers—a significant number but still less than half of SMS. OTT apps, such as WhatsApp, WeChat, and Messenger, collectively attract 4.6 billion users, but this audience is highly fragmented across platforms and regions.

Market Presence

SMS is unmatched in ubiquity: every mobile phone supports it. RBM’s presence is growing, particularly as operators roll out support, but only around 40% of subscribers globally will be able to receive it by 2025.

OTT apps present a more complex picture. While their global presence is undeniable, businesses face challenges in navigating a fragmented environment where success depends heavily on which platforms dominate in a given market.

High Reach Markets

In terms of penetration, SMS remains especially strong in the US, where brands make extensive use of A2P SMS for customer engagement. RBM is rapidly expanding here too, with forecasts suggesting 80% of US subscribers will be enabled by the end of 2025.

OTT channels, however, are often region-specific: China alone accounts for over 1 billion users of OTT messaging apps, while other regions are dominated by different providers such as WhatsApp in India and Latin America.

Metrics & Data

The kind of feedback businesses can expect from these channels also varies. SMS provides useful, though limited, insights such as delivery reports and click-through rates when linked with campaigns.

RBM offers a far richer analytics environment, with read receipts, delivery reports, and open rates available, making it closer to OTT experiences. OTT channels can provide even deeper engagement metrics, but these are app-specific and vary widely, limiting standardisation for global campaigns.

Security Features

Security remains a pressing concern for enterprises. SMS is vulnerable to risks such as spoofing and phishing, which continue to challenge regulators and businesses. RBM significantly improves on this with brand verification, encryption, and Google policy controls, giving businesses greater assurance.

OTT platforms also provide advanced protections, including brand verification and fraud detection, but again these differ between apps, adding another layer of complexity.

Key Takeaways

For businesses in 2025, no single messaging channel provides a perfect solution. SMS still wins on global reach and universality, making it indispensable for ensuring coverage. RBM represents a middle ground, blending scale with rich engagement features that appeal to brands looking for measurable interactions. OTT channels promise deep engagement and advanced tools but require navigating fragmented ecosystems and platform-specific rules.

The most effective strategy will not be about choosing one over the others, but about building multi-channel campaigns that leverage the strengths of each. By combining SMS for reach, RBM for rich functionality, and OTT for personalised engagement, businesses can deliver messaging strategies that are secure, measurable, and globally effective.

Source: A2P & Business Messaging Market 2025-2030

Read the Press Release: Conversational Use Cases Fuel Global Messaging Boom: Nearly 3 Trillion Business Messages by 2030

Download the Whitepaper: Operator Success Strategies in A2P Messaging for 2026

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026