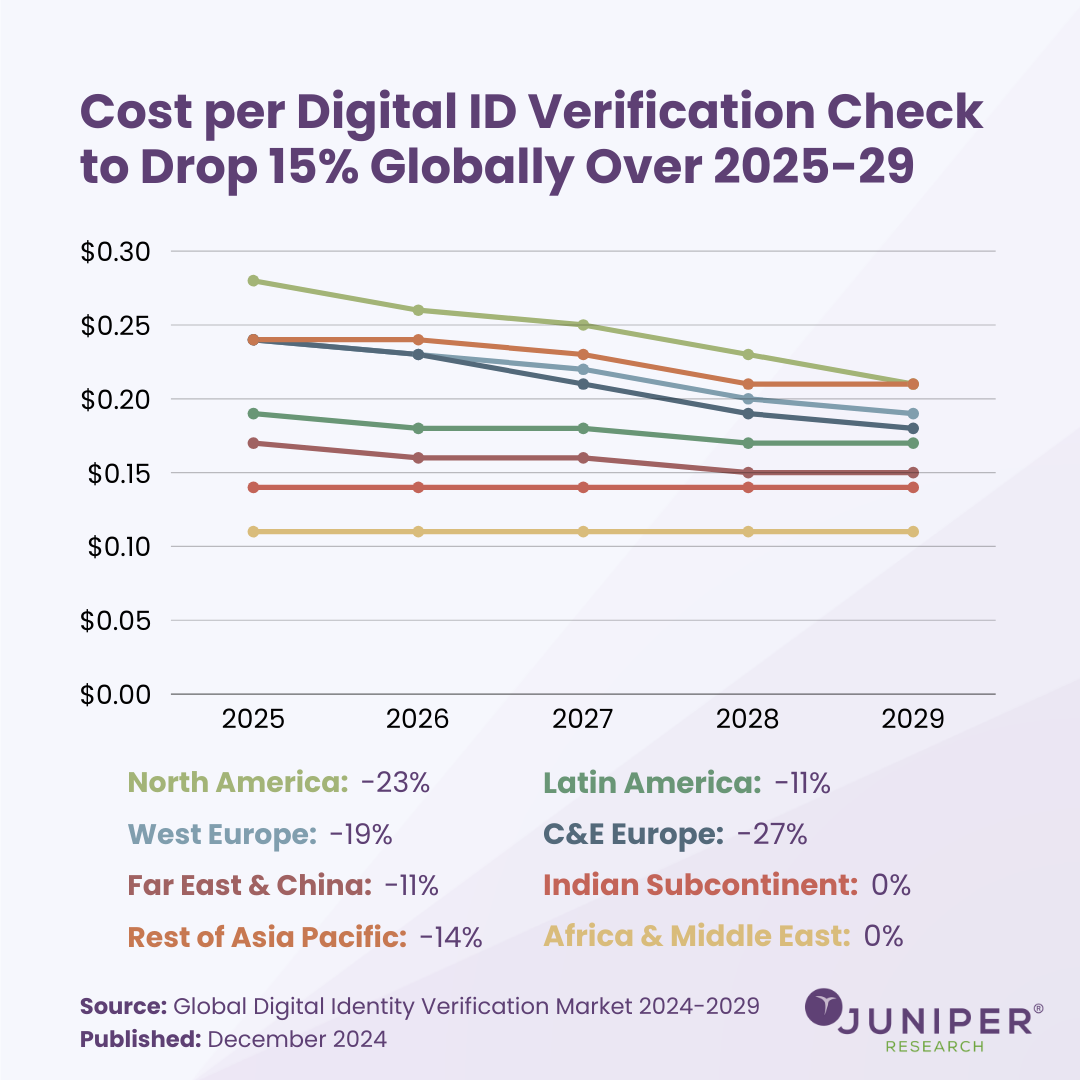

Cost per Digital Identity Verification Checks to Drop 15% Globally

As we discuss in our latest research, the cost of digital identity verification checks is expected to decrease as the process becomes more widespread and the technology matures - with the average price per check dropping from $0.20 in 2025 to $0.17 in 2029, a 15% reduction over the next four years.

This decline reflects improvements in the efficiency and speed of verification processes as businesses adopt automated systems and adapt to managing interventions more effectively. These advancements will further reduce the time required for checks, enhancing overall efficiency.

Digital identity verification involves confirming not just an individual's identity but also their digital attributes through technological methods. It facilitates remote verification, commonly used for customer onboarding, financial transactions, and access management. With increasingly sophisticated fraud techniques, organisations must adopt advanced technologies to safeguard sensitive data. Providers now offer solutions that enhance security and user experience, though specific verification methods may be more effective depending on the context.

The evolution of identity verification has paralleled advancements in the broader identity ecosystem and technology. Historically reliant on in-person document checks, verification methods have adapted to meet the demands of digital commerce and banking. The rise of biometrics, such as fingerprint and facial recognition, has significantly advanced authentication, integrating seamlessly with mobile devices and third-party solutions. Digital identity verification also supports large-scale initiatives like India’s Aadhaar, a biometric-based national identification system that has registered over 1.38 billion users.

Standardisation and interoperability are critical in the digital identity sector. Initiatives such as Kantara and OpenID focus on creating interoperable identity frameworks, while blockchain technologies like Sovrin enhance verification systems. Regional efforts, such as eIDAS in Europe and NIST standards in the US, further drive interoperability and innovation. Private companies, like Apple with its Apple ID, highlight the growing role of mobile devices in enabling secure, online identity verification, reflecting the sector’s increasing importance.

Source: Global Digital Identity Verification Market 2024-2029

Download the Whitepaper: Three Technologies Enhancing the Digital ID Verification Experience

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026