What Will the New Year Bring for Payments?

2025 was an eventful year for payments. Whether it was stablecoin hype taking payments by storm, Pay by Bank scaling up across different markets, or A2A payments growing with the launch of Wero, 2025 saw big shifts in the world of payments.

The important question is, what will the new year bring?

In our Top 10 Fintech & Payments Trends 2026 whitepaper, we highlighted several key trends that will have a major impact on payments this year. Let’s explore three of the most important.

Stablecoins to Rival Existing Interbank Settlement Layer

Cross-border payments are seeing significant change; given their challenges around speed, cost, and transparency. As part of this transformation, we predict that stablecoins will take an important role as a way for banks to settle cross-border payments; bypassing much of the legacy infrastructure in place. This will reduce reliance on traditional rails, and reduce costs and time to send payments.

Agentic Commerce to Reshape B2B & Consumer Purchasing

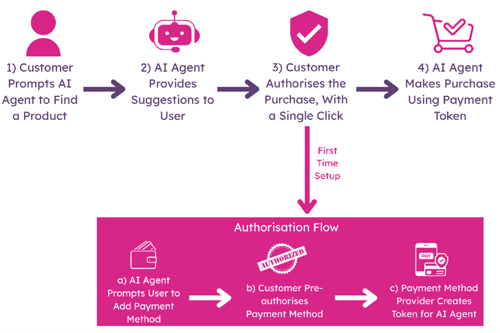

AI is having a major impact on all walks of life. eCommerce will be no different, with AI agents set to transform the way we buy goods and services online. Payments companies were preparing for this in 2025, and we will see much more progress on building the infrastructure this year.

AI Agent Authorisation Flow

Source: Juniper Research

Pay by Bank to Scale in the UK Via Commercial VRPs (cVRPs)

Late 2025 saw clear signs of intent made by the PSR and FCA, in terms of building the foundations to push this alternative payment option into the mainstream. As such, we predict cVRPs will cement themselves as a practical payment option beyond 2026; thereby fuelling Pay by Bank payment options throughout the UK.

Not only will cVRPs become available on a more widespread basis, but international examples show that recurring payments have an important accelerative effect on A2A payment schemes. Recurring payment features such as Pix Automάtico are enabling A2A payments to scale rapidly, and we anticipate that a similar impact will be seen with cVRPs.

What Is Driving These Shifts?

Taken together, these three trends represent a major shift in payments, towards a more programmable, alternative payments-focused future. However, in a payments market many had traditionally seen as slow moving, what is driving this shift?

Clearly, the payments market is moving faster than it has for some time – many changes outside of these trends are also occurring. Fundamentally, there are several reasons why the payments market is changing quickly:

- AI & the Need for Programmability - With the rise of AI, and agentic AI in particular, traditional payment systems designed for humans are not optimised for AI use. Methods such as payment cards are older, and while they have been redesigned to feature elements such as network tokenisation, they are still designed around usage by humans. As such, the need to optimise payments for AI is a major trend, and is driving transformation.

- Sovereignty of Payment Systems - With international events showing no signs of slowing down, governments around the world are increasingly concerned with reducing their reliance on international and US payment systems by having more direct control over which payment systems are used in country. This means that different countries and bodies are focusing on how they can stimulate local payment system growth, which is boosting alternative payment methods.

- Intense Market Competition - Payments and the broader fintech ecosystem are highly competitive, with many large international fintechs, as well as vibrant startup ecosystems and country-level providers in nearly every country. As such, the payments market is saturated in many ways, so there is intense competition to innovate and create new solutions as a way to differentiate. This is a major force in driving the market forwards.

These are not the only factors driving shifts in payments, but they are major forces; powering many of the trends we have predicted for 2026.

What Will We See Longer Term?

In the longer term, we expect to see a continuation of these trends – more payment innovation, more payment methods launching, and more investment. Critically, this will not directly translate into end user adoption. Indeed, we anticipate that the payments market will consolidate as alternative payment methods mature. Having a key reason why users should adopt a service, rather than innovation for innovation’s sake, will be vital to success.

Nick Maynard is VP of Fintech Market Research at Juniper Research, where he leads analysis on key trends shaping the future of finance. With deep expertise across digital payments and commerce, his recent work includes reports on Instant Payments, eCommerce Payments, and Chargeback Management; helping stakeholders stay ahead in a rapidly evolving market.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026 -

Telecoms & Connectivity

AI Agent Spend for Customer Experience to Grow 400% Globally Over Next Two Years

February 2026