What Amazon’s Pay by Bank Launch Means for UK eCommerce

Last week, Amazon expanded UK payment options with Pay by Bank through a partnership with TrueLayer.

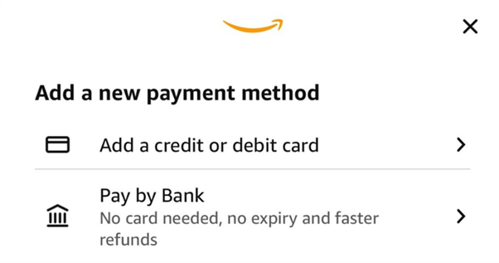

It introduces a card-free, account-to-account (A2A) payment option that lets customers pay directly from their bank accounts using open banking infrastructure. Instead of entering or storing card details, shoppers select their bank at checkout, are securely redirected to their mobile or online banking, and authorise the payment via PIN or biometrics, with funds moving straight from their account to Amazon.

This method mirrors familiar mobile-banking journeys while removing card expiry issues and the need to update stored card details, and it supports near-instant refunds back into the customer’s bank account once returns are processed. Amazon also extends its A-to-Z Guarantee and the protections under the UK Payment Services Regulations to these transactions, which helps to anchor trust in this new rail.

It also allows customers to benefit from faster and more transparent money flows. In many implementations, funds leave the customer’s account and arrive with the merchant in near real time, and refunds can be processed back to the bank account much more quickly than traditional card refunds. Customers keep a clear view of their spending directly in their bank statements, and can combine Pay by Bank with their existing bank security settings and alerts, giving a sense of control and visibility over each payment.

Across the UK payments landscape, the move is widely seen as one of the strongest endorsements yet of open banking and A2A payments by a global eCommerce leader, signalling that A2A is ready for prime-time in mainstream retail. By sidestepping card networks for some transactions, Amazon can reduce scheme and interchange fees and benefit from faster settlements, while banks and open banking providers gain a powerful proof-point for their infrastructure at scale.

If customer adoption grows, even a modest shift of Amazon’s UK volume from cards to Pay by Bank could meaningfully erode card share in eCommerce and prompt schemes, issuers and PSPs to sharpen pricing and differentiate more on value-added services such as instalments, rewards and advanced fraud controls. The launch also aligns with the UK’s National Payments Vision, which explicitly encourages A2A in eCommerce to deliver more efficient, secure and competitive payment options.

Giving the People What They Want

That strategic significance ultimately rests on customer behaviour.

Expanding payment options at checkout also aligns closely with evolving customer expectations in the UK, where research shows that a significant share of shoppers will abandon purchases if their preferred payment method is not available or the checkout journey feels cumbersome. UK consumers have rapidly adopted mobile and digital wallets, and there is growing comfort with open-banking payments, with a MoneyHub survey indicating that 45% of respondents feel comfortable using them for regular bills and 39% for larger transactions.

By adding a secure, bank-native option that fits seamlessly with modern mobile-banking habits and offers instant refunds and strong protections, Amazon is responding to this demand for more flexible, intuitive and trusted ways to pay online. In doing so, it not only enhances its own checkout but also raises the bar for what UK customers will expect from other merchants, potentially making a broader mix of cards, wallets and A2A Pay by Bank options the new norm across the market.

Key benefits for consumers include:

- Card details do not need to be entered or stored, increasing security.

- A familiar user experience as your mobile-banking app is used to authenticate via your PIN or preferred biometrics, increasing user trust.

- Faster refunds, with money returned to your bank account within minutes after Amazon confirms a return.

- No card expiry or card-detail updates, because the payment method is linked to your bank account rather than a physical card.

- Set up is incredibly quick and simple, and represents a low barrier to entry.

Wider Industry Effects

The sectors likely to feel the impact first are online retail and digital subscriptions, where transaction costs, authorisation rates and refund experiences are critical to margins and customer satisfaction. Amazon is initially enabling Pay by Bank for retail purchases on amazon.co.uk, and it claims the ability to pay for Prime membership is coming soon, directly challenging card-on-file in one of the UK’s flagship subscription products.

Over time, normalising Pay by Bank on such a large platform is expected to spill over into other verticals that are both digital-first and price-sensitive, including other marketplaces, travel and ticketing, utilities and telecoms, where merchants are already exploring open-banking A2A for bills and recurring payments. For PSPs, gateways and challenger acquirers, this creates a strong incentive to productise similar “pay from bank” buttons and instant-refund capabilities for their merchant bases, accelerating competition around A2A offerings.

As a Senior Research Analyst within Juniper Research’s Fintech and Payments team, Thomas provides up-to-date trends analysis, competitive landscape appraisals, and market sizing for financial markets. His most recent reports have covered areas including Digital Wallets, A2A Payments, and Digital Identity Verification.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026 -

Telecoms & Connectivity

AI Agent Spend for Customer Experience to Grow 400% Globally Over Next Two Years

February 2026 -

Fintech & Payments

Fraudulent eCommerce Transactions to Surpass $131 Billion by 2030 Globally; Driven by Escalating Friendly Fraud

February 2026