No Hardware, No Hassle: How Smartphones Are Powering the Next Wave of Small Business

For small businesses, navigating the set-up of payment acceptance can be confusing and expensive, often requiring significant upfront costs to set up a website, checkout, and POS terminal. However, merchants can now do all these things with just a phone, making it easier and more affordable to start and run a business.

Payments innovations have transformed the process of setting up a business, reducing the level of capital entrepreneurs need to invest to start accepting payments. One way this is happening is through the eradication of the need to buy POS terminals and associated hardware. While these remain relatively cheap, the upfront cost or monthly subscription can still be out of reach for those with smaller, more sporadic use cases, including garage sales and social media marketplace transactions.

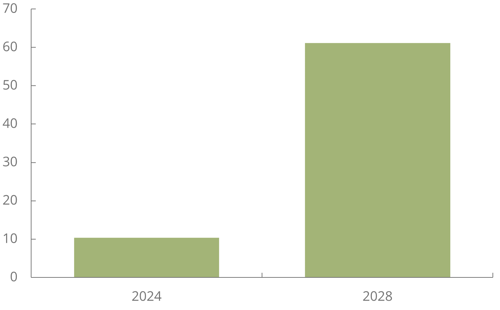

With Apple's Tap to Pay on iPhone and Stripe's Tap to Pay on Android, everyday merchants can sign up with a payments platform and download an app which enables them to accept payments directly from their phone, with the cost generally being included as part of the percentage fee that payments platforms take from each transaction. Tap to Pay capabilities allow merchants to accept contactless credit and debit cards and digital wallets by using an app to unlock NFC capabilities on the phone. This feature was released by Apple in February 2022 for the US, July 2023 for the UK, and then rolled out for other countries such as Australia, Brazil, France, and Japan. As seen in the figure below, the adoption rate of phones using soft POS devices are expected to be high, growing by almost 490% between 2024 and 2028.

Global Number of Contactless-enabled Smartphones Using Soft POS (m)

Source: Juniper Research

Small Businesses: Social Commerce and eCommerce

This low-effort set-up for in-person sales mirrors innovations within eCommerce payments which allow merchants to start selling online from scratch with no upfront costs. For example, payment processing providers often provide end-to-end services, supporting the whole process of online sales from hosting a checkout to accepting payments and providing visuals of cash flow. Merchants can set up and view these processes from an app on their phone, with no code necessary to develop and integrate these features into their sales cycle.

The playing field between large enterprises and smaller businesses has been further levelled through large commerce platforms such as Shopify providing small eCommerce businesses with features that would be difficult for them to develop themselves. For example, advanced payment technologies such as smart fraud protection and localised checkouts are typically costly and complex to integrate separately. However, the rise of the Payments-as-a-Service model allows small businesses to access and benefit from these technologies through a single integration, enabling them to compete more effectively.

The rise of social commerce - sales channels located within social media profiles - now means that entrepreneurs do not even need to launch a website to be successful sellers. Instead, they can embed payment links directly in their Instagram posts or TikTok videos, allowing buyers to purchase items without leaving the platform. This is likely to benefit small sellers over large ones, as the social nature of these sites means that individual influencers have the advantage over brand accounts.

The Future of NFC Payments

An extension of the Tap to Pay feature has been announced by Apple at WWDC 2024. As part of their iOS 18 updates, a ‘Tap to Cash’ feature will be released to let users pay for things by tapping two iPhones together, utilising the NFC functionality so money can be transferred without any personal details such as a phone number being shared.

Source: Apple

This update, expected to be released in Autumn 2024, reflects the demand for seamless, fast transactions in the payment market, as the Tap to Cash functionality skips the usual steps of selecting a contact and initiating payment manually when sending a P2P (Person-to-Person) payment. As with other P2P payments, there will likely be some use by small merchants instead of using formal merchant payment methods.

This use of NFC functionality is not restricted to phones and payments; as a replacement for business cards, Gen Z entrepreneurs are sticking NFC tags to their nails, laminating them with polish, and programming them to their website. These open to their eCommerce shop when tapped to a phone, providing them with a true omnichannel method to reach customers and reflecting how NFC technology can enhance every aspect of the sales cycle.

With Tap to Pay and the rising power of social commerce turning phones into powerful sales tools, starting and running a small business has never been easier. These low barriers to entry are unlocking digital transformation for even the smallest merchants, and will accelerate the transition away from cash in many markets.

Lorien is a Research Analyst in the Fintech and Payments team at Juniper Research, and specialises in analysing and forecasting emerging trends and innovations in financial markets. Her latest reports have covered topics including Subscription Economy and Modern Card Issuing Platforms.

Latest research, whitepapers & press releases

-

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030Our Cross-border Payments research suite provides a comprehensive and in-depth analysis of the evolving cross-border payments landscape; enabling stakeholders such as businesses, financial institutions, payment service providers, card networks, regulators, and technology infrastructure providers to understand future growth, key trends, and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW

-

WhitepaperMarch 2026Telecoms & Connectivity

WhitepaperMarch 2026Telecoms & ConnectivityMWC 2026: What's Next for Mobile?

Our latest whitepaper distils the most important announcements from MWC Barcelona 2026 and examines what they mean for the telecoms market over the year ahead. From network APIs and 5G monetisation to AI-RAN, direct-to-cell connectivity, and 5G-Advanced, it explains where the biggest opportunities — and challenges — will emerge next.

VIEW -

WhitepaperMarch 2026Fintech & Payments

WhitepaperMarch 2026Fintech & PaymentsThe Transformation of Cross-border Payment Infrastructure

Our complimentary whitepaper, The Transformation of Cross-border Payment Infrastructure, examines the state of the cross-border payments market; explaining the role of key actors in transforming the cross-border payment experience, as well as the current landscape and recent developments within the cross-border payments industry.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW

-

Fintech & Payments

Top Three Global Leaders in Cross-border Payment Infrastructure Revealed

March 2026 -

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026