Infobip Analyst Summit Highlights: What’s Next for CPaaS and Messaging?

The mobile messaging landscape is undergoing a transformation. Brands are rethinking how they use messaging channels, driven by a clear shift in consumer expectations: people don’t just want messages: they want conversations. In response, the market is stepping up, rolling out technology that enables more interactive, real-time engagement across a growing range of use cases.

This evolution is also reshaping the role of Communications Platform-as-a-Service (CPaaS) providers. No longer just the pipes behind the messages, they’re now positioning themselves as strategic partners, offering customer interaction tools that support the full customer journey; from first contact to long-term loyalty.

At last week’s Infobip Industry Analyst Summit, Ivan Ostojić, Chief Business Officer at Infobip, spotlighted three major trends driving this shift in both market demand and supply. In this piece, we’ll unpack those trends and share our perspective on what they mean for the future of mobile messaging.

Source: Molly Gatford

The Conversational Messaging Boom

One of the biggest trends highlighted by Ivan Ostojić was the rising consumer preference for interacting with brands through messaging; not just receiving updates, but having real, two-way conversations. This surge in conversational messaging is fuelling the adoption of more interactive channels, such as over-the-top (OTT) messaging apps and Rich Communication Services (RCS) business messaging.

Enterprises are increasingly turning to these channels not only for customer support, but also to drive sales and marketing; transforming messaging into a powerful, multi-functional engagement tool.

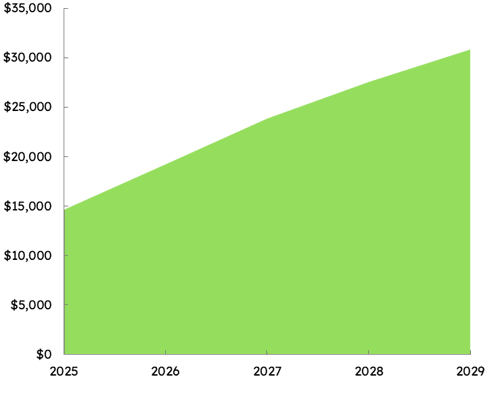

We’ve seen this shift firsthand in our own research. In our latest CPaaS report, we project a significant rise in the number of OTT and RCS business messages delivered via CPaaS platforms - a nearly 200% growth over the next five years. As conversational interactions become the norm, this growth will be driven by brands meeting consumers where they want to engage: in chat.

The chart below illustrates just how quickly this transformation is unfolding.

Total OTT & RCS Business Messages Delivered by CPaaS Platforms Globally (m), 2025-2029

Source: Juniper Research

Source: Juniper Research

Messaging Apps Are Becoming Superapps

OTT messaging apps and Google’s RCS are rapidly evolving to meet rising demand for conversational messaging. These platforms are becoming more like superapps, adding rich features that support a wider range of use cases; from shopping and payments to booking appointments and finding locations.

Superapps like WeChat have long led the way by offering a single destination for messaging, payments, eCommerce and more. Ivan Ostojić highlighted that apps like WhatsApp are moving in this direction, with added functionality including payments, calendars, maps, carousels, and deeper integrations. This shift is enabling enterprises to build more advanced, interactive customer journeys directly within these apps.

But why does it matter if messaging apps become superapps?

Because the more functionality these platforms offer, the more opportunities brands have to meet customers where they are, and deliver seamless, end-to-end experiences. The rise of superapps reflects not only the growing popularity of conversational messaging, but also broader shifts in how consumers behave online and what they expect from digital interactions.

Beyond two-way chat, we’ve identified two additional trends fuelling this evolution:

- Personalised experiences - Consumers now expect every interaction to be tailored — whether it’s a product recommendation, special offer, or follow-up message. OTT messaging platforms are enabling this by making it easier to deliver personalised, data-driven content within the conversation itself.

- Instant, interactive purchases - Shoppers are increasingly looking for convenience. Features like click-to-chat and in-app payments allow brands to remove friction, making it possible to browse and buy in one fluid experience.

These shifts come at a time when many traditional marketing channels, like email, are becoming overcrowded. To cut through the noise, marketing teams are turning to messaging; not just for support or alerts, but as a high-impact engagement channel. In our own work, we've observed a growing share of CPaaS demand coming from marketing departments, and we expect marketing-led use cases to be a major driver of CPaaS revenue in the coming years.

Retail and eCommerce brands are expected to lead the way, experimenting with new messaging features to better connect with their customers. CPaaS providers, in turn, must ensure they’re offering tools that simplify and enhance this process; from automating template creation to supporting advanced use cases through value-added services.

Generative AI’s Growing Role in Customer Engagement Strategy

Generative AI is no longer just a buzzword; it’s becoming a foundational part of how brands connect with customers. As Ivan Ostojić pointed out, AI tools are being used to power chatbots and virtual agents, enhance human interactions, support marketing campaigns, and even help prevent fraud.

At Juniper Research, we’re closely monitoring this shift. In fact, we expect generative AI to be a key driver behind the projected 110% growth in conversational AI service revenue between 2025 and 2029.

Total Conversational AI Services Revenue ($m), 2025–2029

Source: Juniper Research

Source: Juniper Research

Tools like ChatGPT have already changed how users interact online. For many consumers, AI-powered chat has become a natural part of daily life. These tools haven’t just responded to demand for conversational experiences; they’ve created it. In turn, AI vendors are ramping up efforts to bring even more advanced models into the enterprise space.

Over the past year, we’ve seen a significant expansion in the range of generative AI models available, many of which are tailored to specific enterprise needs. This is helping to bring costs down while making the technology more accessible. Meanwhile, building and deploying chatbots has become increasingly self-service; opening the door for more companies to experiment with conversational AI, even without deep technical expertise.

Still, we believe the true potential of generative AI in customer engagement has yet to be fully realised. While there’s no shortage of imagination in how vendors are applying these tools, many enterprises are still grappling with how to measure real impact, from increased engagement to more efficient support.

Once the industry has more proven ROI metrics and high-profile success stories, though, we expect adoption to accelerate rapidly. Enterprises will no longer just be experimenting; they’ll be investing.

Juniper Research would like to thank the Infobip team for inviting us to this year's Infobip Industry Analyst Summit; and a special thanks to Hannah Kirkman and Marlies Roest for organising such a great event.

Molly is a Senior Research Analyst at Juniper Research, providing insight, data, and recommendations for established and future markets within the telecommunications sector. Her recent reports have covered topics including CPaaS, Conversational AI, and RCS Business Messaging.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026