Google’s Project Suncatcher and Why Space May Become AI’s New Home

AI is rapidly advancing and proliferating; from simple text-based queries popularised by the launch of ChatGPT in 2022, to AI-generated videos now almost indistinguishable from real life, save for the faint ‘Sora AI’ watermark. The emergence of AI-enabled robotics adds yet another layer of demand, with machines requiring continuous connectivity to data centres to function intelligently.

However, AI’s growth comes with a substantial burden on power systems. A December 2024 report by the US Department of Energy predicts that AI data centres will consume up to 12% of the country’s electricity by 2028, compared with 4% in 2023. As a result, building, running, and leasing data centres is becoming increasingly expensive: electricity demand is rising, pushing prices higher, while larger facilities require greater power input, forcing utilities to upgrade grids: costs that ultimately feed through to end-users. These pressures are expected to continue as AI adoption accelerates.

At the same time, the environmental impact of data centres is escalating. Larger facilities require more land, power and cooling, increasing their footprint and intensifying their effect on surrounding areas. Northern Virginia - widely regarded as the data centre capital of the world - illustrates this clearly, with residents and advocacy groups frequently raising concerns about noise and air pollution.

Current Data Centres in North Virginia

Source: VEDP

Source: VEDP

Without meaningful intervention, electricity usage in countries leading AI development, particularly the US and China, is likely to double over the next decade.

One radical intervention now being explored is building data centres in space. Google’s Project Suncatcher - announced last month - is the most comprehensive plan to date for launching data centre infrastructure beyond Earth. The project, outlined via a blog and research paper, sets out Google’s ambition to construct scalable Low Earth Orbit (LEO) data centres to power AI workloads on Earth.

Google plans to launch two prototype satellites equipped with its Tensor Processing Units (TPUs) in 2027 in partnership with Planet, a satellite imagery company, before expanding to a potential 81-satellite constellation in 2030. TPUs are custom chips developed by Google to power machine learning. According to the research, the constellation will deliver computational capacity comparable to terrestrial facilities. The satellites will use Free Space Optics (FSO), Dense Wavelength-Division Multiplexing (DWDM) and Spatial Multiplexing (SM) technologies to transfer data between one another.

Industry support is emerging. Elon Musk and Jeff Bezos have publicly expressed interest in the broader concept of space-based data centers and AI infrastructure in orbit, and both possess the influence, launch capability and capital to help drive it forward. Additional involvement from companies beyond Google will be essential to scale momentum and reduce cost barriers.

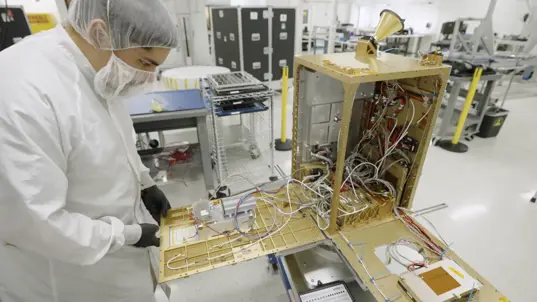

Progress is visible elsewhere too. Starcloud, a startup backed by NVIDIA and Y Combinator, launched a satellite in November 2025 containing an NVIDIA H100 GPU in a pilot test. Like Google, Starcloud aims to establish data centres in space; initially powered by NVIDIA hardware.

Source: Starcloud/NVIDIA

Advantages of Data Centres in Space

Space-based data centres address many of the issues associated with terrestrial facilities, particularly energy. In LEO, data centres can access near-constant solar energy, removing demand from national grids and reducing environmental impact relative to power usage. This renewable supply bypasses the need for utilities to invest in grid upgrades to meet rising demand.

Space also offers potential cooling advantages. Near-vacuum conditions could enable radiation-based cooling for TPUs used in AI services. While technically complex, Juniper Research believes this could provide significant long-term benefits, avoiding future regulations surrounding water usage and natural resource consumption.

Although launching satellites is costly, prices are expected to fall over the next decade. Google’s Suncatcher research suggests launch costs may drop below $200/kg by the mid-2030s. At this level, the amortised launch cost over spacecraft life could approximate terrestrial data centre energy expenses on a per-kW basis.

Challenges

Despite the progress, major obstacles remain. Space is an extreme operating environment. Radiation can damage key components, including processors and GPUs. Google reports testing its v6e Trillium TPU using a 67MeV proton beam to simulate ionising radiation, with results showing no failures attributable to the exposure. While promising, laboratory results cannot perfectly replicate fluctuating space conditions.

Physical risks also exist. Debris and micrometeorites travel at hypersonic speeds of around 17,500 miles per hour and can damage satellites. Unlike terrestrial data centres, repairs are complex, slow and costly; frequent failures could erode potential savings if repair missions become necessary.

Orbital congestion adds another challenge. SpaceX reported 144,000 manoeuvres from December 2024 to May 2025 - around 791 per day - to avoid debris. Google notes that its satellites will use a machine learning-based flight control model to maintain proximity while avoiding collisions, but provides little detail on redundancy or real-time management, raising questions about long-term reliability.

Technical complexity also arises when deploying FSO, DWDM and SM simultaneously. These systems can interfere due to atmospheric turbulence, causing beam wandering or distortion. Google acknowledges this and suggests aligning satellites closely to minimise divergence, but implementation remains demanding.

Conclusion

For Google to succeed in this endeavour, it must implement an autonomous collision-avoidance system similar to Starlink’s, powered by onboard AI. As LEO becomes increasingly congested, Juniper Research expects it to become more difficult for enterprises to safeguard constellations; making advanced avoidance systems essential. Redundant provisioning may not be sufficient if physical damage renders satellites inoperative or disrupts network integrity.

For space-based data centres to reach their full potential, Juniper Research recommends collaborative effort among vendors such as SpaceX, Google, NVIDIA and Amazon; pooling capabilities to design technology that enables consistent and reliable operation in space.

Ardit works within the Telecoms & Connectivity team; providing insights and strategic recommendations on current and future markets within the telecoms industry. His primary area of focus is on operator and CSP strategies. He previously worked at GlobalData for four years where he covered the technology and telecommunications industries, and prior to that, worked at Gartner for two years.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026