Beyond the Hype: The 4 Biggest Takeaways from CES 2025

#1: Physical AI is Primed for Development, but ROI Remains Elusive

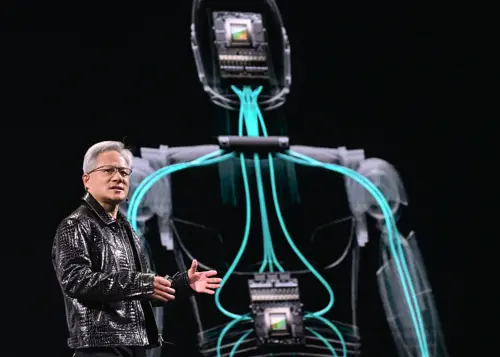

NVIDIA’s CEO Jenson Huang commenced CES 2025 with the opening keynote speech that revealed several pioneering AI announcements from the technology giant. One of the key announcements from NVIDIA was the unveiling of its physical AI platform, NVIDIA Cosmos. Physical AI is defined by NVIDIA as AI that extends current generative AI models by having an awareness and understanding of the spatial relationships and physical behaviour of a 3D or physical world. Physical AI will enable the use of autonomous machines, including robots and self-driving cars.

Source: NVIDIA

NVIDIA Cosmos will come with state-of-the-art generative World Foundational Models (WFMs), advanced tokenisers, guardrails and an accelerated video processing pipeline that will aim to accelerate the development of physical AI systems. However, large amounts of data are required to train physical AI systems to successfully navigate a physical world, and NVIDIA’s WFM aims to provide an effortless way to generate substantial amounts of physics-based synthetic data that will facilitate the fast training and evaluation of these physical AI systems. The platform will streamline the process of training; making it more cost and time-effective for end users.

While physical AI is expected to optimise several applications, including self-driving cars, traffic-control systems and surgical rooms, NVIDIA’s Vice President of Omniverse and simulation technology, Rev Lebaredian, identified the industrial sector and predicted that it will bring AI to 10 million factories and 200,000 warehouses.

In addition, NVIDIA announced that they would be furthering its support for agentic AI, with new AI blueprints that simplify the development of AI agents. Agentic AI consists of multiple AI agents that work together to independently set and meet goals based on user input, making them capable of solving complex, multi-layer problems. Whereas generative AI generates results based on patterns it learns in training, agentic AI can generate results by understanding both the context and goal of a task. In collaboration with leading agentic AI providers, including CrewAI, Daily, LangChain, LlamaIndex, and Weights & Biases, NVIDIA’s new AI blueprints integrate NVIDIA’S AI enterprise software platform, NVIDIA NIM microservices and NVIDIA NeMo.

Source: NVIDIA

These announcements usher in a new era of AI models with greater contextual understanding that are set to significantly disrupt how enterprises operate, allowing for the automation of key tasks with higher accuracy. However, given the nascency of these two technologies, there are several obstacles that the market must overcome before the widespread adoption of both physical and agentic AI.

- Despite NVIDIVA’s efforts to streamline training for physical AI systems, deployment cost will remain substantial and integration into existing systems will remain complex.

Vendors looking to deploy physical AI or agentic AI must focus on providing optimised models that are less resource-intensive and sustainable, allowing for lower maintenance costs. This will make these two technologies accessible to a wider audience and allow for the widespread adoption of both agentic and physical AI in the long run.

- Secondly, to build market confidence, vendors deploying physical AI or agentic AI must cultivate portfolios of case studies by partnering with large industry leaders.

This will not only instill confidence in potential users from real-world examples but will also allow them to acquire industry-specific expertise that will allow them to offer unique and value-added services which will allow them to further penetrate the market.

Juniper Research anticipates that, over the next year, large industry leaders will experiment by deploying the technology in sandbox conditions so as to not disrupt well-refined revenue-generating processes. The key to widescale adoption now is proof of return on investment (ROI) – without this, the technology will never progress.

#2: The Increasing Need for Tech Partnerships in Automotive

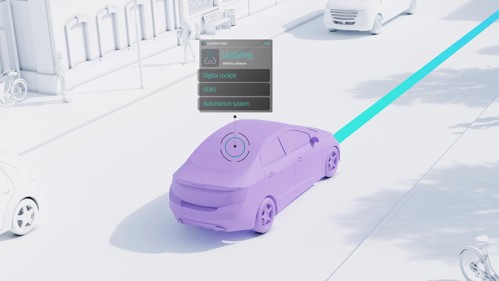

Amazon announced several key autonomous vehicle partnerships at CES 2025; solidifying the technology giant’s presence in the autonomous vehicle market. One of the key partnerships it announced was a ten-year cloud infrastructure agreement between its subsidiary Amazon Web Services (AWS) and HERE technologies, a Dutch multinational group that specialises in mapping technologies and location data.

The partnership will aim to provide a streamlined solution for the development of location-aware technologies, which will further enhance advanced driver-assistance systems (ADAS) and automated driving (AD) for the automotive, logistics and mobility companies worldwide.

Source: HERE

The partnership will achieve this by combining AWS’ cloud expertise and HERE’s location intelligence to support the automotive industry in developing and deploying AI-powered, live streaming location services in real-world applications.

It will also address key challenges in deploying ADAS and AD solutions in the automotive industry by providing services that accelerate both the testing and real-world deployment of ADAS and AD solutions. For example, automative developers can now easily locate and deploy the HERE HD map into simulations for testing, using both the HERE HD Live Map in conjunction with AWS’ AI tools such as Bedrock.

In addition to this partnership, AWS has agreed a similar partnership with French global automotive supplier, Valeo. The partnership will entail Valeo offering new solutions, powered by AWS, which will aid the development process of software-defined vehicles (SDVs), allowing for faster, cost-efficient deployments of SDV technologies.

Furthermore, Amazon has also entered into an automobile technology partnership with Qualcomm to develop advanced in-vehicle experiences. The partnership will see Qualcomm’s automotive expertise combined with Amazon’s AI capabilities to advance personalised and cutting-edge driving experiences; allowing automobile manufacturers a faster, flexible and cost-effective method to develop advanced infotainment and AI features. It will also aim to provide a virtual environment for automobile manufacturers to develop and test infotainment and driver-assistant technologies.

Amazon will also start rolling out large language model (LLM)-powered capabilities with its partner BMW. This follows the partner’s successful roll-out of the new BMW Intelligent Personal Assistant (IPA), powered by Amazon’s Alexa Custom Assistant (ACA) technology, in BMW’s X3 model in July 2024.

Source: Amazon

The partnerships of both Amazon and AWS with automotive companies and automotive technology companies highlight the shift of the automobile market to an intelligent, software-centric and cloud-connected future. The navigational advancements that this shift will bring will not only enhance the automotive industry, but the logistics industry as well; providing more efficient supply chain management. Amazon’s key partnerships will accelerate the development of SDVs, however we foresee several key hurdles that Amazon and its partners, as well as other competitors in this industry, will have to overcome to successfully deploy these technologies.

The biggest challenge will be regulatory hurdles and gaining market confidence. Similarly to the physical and agentic AI market, these hurdles can be overcome by forming partnerships and collaborations with regulatory bodies, such as WP.29. These collaborations must involve streamlined certification processes that balance thorough testing with efficient deployment roll-outs, and promote collaboration.

Cybersecurity will also be a key concern, and technology and automobile companies must also work with regulatory bodies to create standards and certification programmes to enhance the deployment of these technologies, as well as to increase market trust. Lastly, the shift to SDVs will also provide a unique workforce obstacle where the existing workforce will need to be reskilled to support this shift. Automobile and technology vendors in this industry must invest in educational programmes and workshops to support their workforce through this transition.

#3: Questions Raised over Quantum Development Timelines & ROI

When questioned by analysts on the outlook for quantum computers, NVIDIA CEO Jensen Huang implied that quantum technology was at least 20 years away; claiming that a return on investment in 15 years would be considered early, and in 30 years, late. This resulted in a plunge in stock of key quantum technology leaders, including IonQ, Rigetti, Quantum Computing Inc and D-Wave Quantum, with shares crashing by almost 40%.

While quantum technology is an exciting prospect, particularly in advanced optimisation solutions that will transform sectors with complex models, such as finance and logistics, there are key challenges which are inhibiting growth in the quantum market. The nature of qubits, which are bits of quantum information, require cryogenic systems that are expensive to operate. In addition, qubits suffer from quantum decoherence; a phenomenon where they lose their quantum state and convert to a classical state due to interactions with their environment.

This can lead to information loss and errors. Quantum error correction methods, which use algorithms to protect quantum information by redundantly encoding quantum information across several qubits, can be used to mitigate these errors, but these methods can be computationally expensive to implement successfully. These two factors therefore add to the high cost of maintaining a quantum computer, let alone purchasing one, making quantum technology difficult to access for substantial portions of the market.

While these hybrid quantum classical computers cannot perform on the same level as quantum computers, they currently provide an assured method of achieving optimised quantum computing in real-world scenarios, without the challenges quantum and supercomputers currently face.

A good example of is this the solution that Q-CTRL provided for the Australian Army’s convoy in February 2024. Its task was to find the most optimised route for travelling, saving costs and time. Previously, quantum computing solutions had been an issue, due to error detection and correction, as well as noise. However, quantum company Q-CTRL deployed a hybrid solution, which was able to provide a highly optimised route for the army.

The popularity of offering quantum-as-a-service (QaaS) is also growing; allowing companies to access quantum computing without the high implementation and maintenance costs. Although prices remain high compared to other ‘as-a-service’ business models, it has greatly increased accessibility of quantum computers.

These two solutions, combined with large government investments particularly from countries such as the US, China, the UK, Japan, South Korea, Germany and France, will drive a large amount of innovation in the quantum technology market. Juniper Research anticipates that global cumulative investments will reach $45 billion by the end of 2025; a 139% increase from 2023. This will be driven by a quantum technology race between the key leading countries mentioned above, with governments focused on ensuring that they remain up to date on quantum innovations, particularly those relating to national security.

Although quantum technology is physically fragile, and expensive to implement and maintain, its development is similar to AI, which has seen increasing investment over the last decade and is now considered a well-established and well-defined technology. Depending on the model, AI can be computationally expensive and time consuming to train to start obtaining highly precise results.

#4: IoT to Focus on Service Simplicity for SMEs to Achieve Growth

The computer intelligence company Qualcomm announced the upgrade of its cloud-based Qualcomm Aware platform. The upgrade will include new key features that allow companies to include observability, monitoring and location capabilities to intelligently connected IoT devices in industries such as energy and logistics.

Source: Qualcomm

The additional features of the horizontal IoT enablement platform aim to tackle some of the key challenges in building; customising and deploying intelligent connected solutions. The features include observability and insights, geolocation, fine indoor positioning, firmware updates and device management services. This will allow device manufacturers and original equipment manufacturers (OEMs) to gain enhanced intelligence into connected devices which will allow them to troubleshoot devices as well as take preventative measures to fix issues that are observed. This will also enable OEMs and device manufacturers to gain insights into delivery efficiency and allow users to ensure the longevity of devices by easily keeping them up to date on the latest firmware and software updates.

Given the global increasing digital transformation and the increasing number of connected devices, enterprises are rapidly adopting IoT solutions, which themselves are rapidly evolving. However, these solutions are also growing in complexity, and security becomes a significant concern as many IoT devices may not be properly secured.

The new features that Qualcomm has added will allow enterprises and industries to gain industry-specific insights and increase innovation. In addition, these features will allow device manufacturers and OEMs to refine their products and software, allowing for more enhanced visibility into IoT infrastructures and simplifying previous complex IoT ecosystems. Juniper Research anticipates that the total number of connected IoT devices will reach 21 billion by the end of 2025. These solutions will be especially valuable to small to medium-sized enterprises (SMEs) who may not have the required level of expertise to implement and manage the growing number of connected devices.

Total Number of IoT Devices (bn), 2024-2029

Source: Juniper Research

As such, Juniper Research anticipates that platforms which provide greater insights into IoT devices will be key to ensuring both secure and enhanced IoT solutions, as well as streamlining the manufacturing and deployment processes of IoT devices.

As a Research Analyst within Juniper Research's IoT & Emerging Technology team, Michelle provides insight and analysis on the latest developments in nascent, fast-growing technology markets. Her latest reports include IoT Cybersecurity, Advanced Air Mobility, and Quantum Technology.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW

-

Fintech & Payments

Mobile Money Users in Emerging Markets to Reach 2.2 Billion by 2030, as Interoperability and Integration Drive Growth

February 2026 -

Telecoms & Connectivity

Juniper Research Unveils 2026’s Telecoms & Connectivity Award Winners

January 2026 -

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026