Behind the Scenes of Juniper Research’s Mobile Messaging Competitor Leaderboard

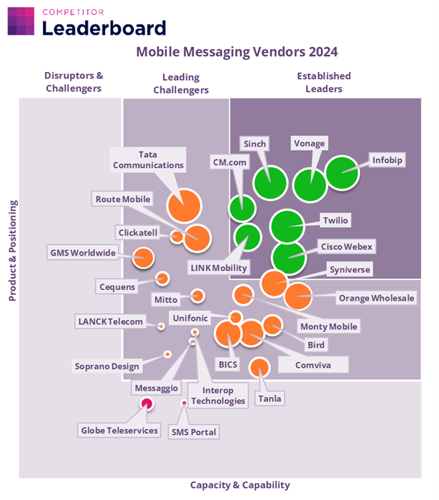

Juniper Research’s latest Mobile Messaging Leaderboard assessed the vendor positioning of 27 mobile messaging vendors, ranking Infobip as the leading vendor in this highly competitive market. This formed part of Juniper Research’s wider report, Global Mobile Messaging Market: 2024-2029.

To be considered for the Mobile Messaging Leaderboard, vendors must directly provide mobile messaging solutions. Factors such as the company’s scale and product offering are evaluated to make an informed decision as to whether a company fits the profile to be included. We cannot guarantee that our list of vendors is exhaustive, but Juniper Research believes the vendors included to be at the forefront of the market.

Here, we will discuss the factors influencing a vendor’s positioning in the Leaderboard, alongside a exploration of why the top scoring vendors are leading the mobile messaging market.

Shown below is the Mobile Messaging Competitor Leaderboard for 2024.

The Competitor Leaderboard is made up of two primary categories, Product & Positioning and Capacity & Capability, which make up each axes of the Leaderboard. Each of these categories is split into five subcategories, in which vendors are quantitatively scored on aspects of their mobile messaging product and solution. Below, each of these criteria are broken down, to help readers understand the factors that aid in our scoring of each vendor.

Capacity & Capability

Below are a few of the criteria utilised to assess a vendor’s capacity & capability in the Mobile Messaging market:

• Experience in the Mobile Messaging Market – for this criteria, Juniper Research assessed the length of time each vendor has offered solutions related to mobile messaging. This criterion also considered the degree of disruption that a vendor’s new solutions have had on the market.

• Size of Operations in the Sector – this considers factors such as number of messages deployed and the number of countries that services are offered to, in order to identify a vendor’s size of operations in the mobile messaging sector. Additionally, it considers the physical office presence of each vendor.

• Extent & Breadth of Mobile Messaging Partnerships – this assessed both market-specific partnerships and direct relationships with mobile network operators, to identify the range of collaborations that a vendor is engaged in. Within this criterion, the extent of partnerships was evaluated, such as if it is a reseller partnership or technology partnership, combining the two enterprises’ capabilities to create a joint solution.

Product & Positioning

Below are a few of the criteria utilised to assess a vendor’s product & positioning in the Mobile Messaging market:

• Mobile Messaging Service & Product Offering – this criterion assessed the services offered over mobile messaging channels, including the variety of technologies supported by each vendor. For example, a vendor may support all messaging platforms, but not necessarily be the highest scoring vendor due to not offering solutions such as commerce and chatbot functionalities over the channels. Therefore, the range of channels was combined with the depth of their solutions.

• Extent of Innovation in the Mobile Messaging Market – this assessed the extent of innovation in a vendor’s solution or product offering. Here, Juniper Research’s opinion on a vendor’s innovation, or plans for innovation, was utilised, with discussions from vendor briefings critical for facilitating scoring.

• Mobile Messaging Market Coverage – this criteria investigated the range of markets that the mobile messaging platform serves, as well as the extent of operations in each market. More specifically, the breadth of industries that a vendor provides mobile messaging services to was assessed, alongside direct connections with operator networks and enterprise customers.

Infobip’s Leading Global Position Explained

Infobip scored highly in a wide range of criteria, with its innovation in conversational AI chatbots for RCS (Rich Communications Services) and RBM (RCS Business Messaging) proving to be particularly innovative in the mobile messaging market, as the company invests in a market set for rapid expansion. This, alongside Infobip’s early movement with communications APIs, specifically its RCS Business Messaging API, contributed greatly to its leading position in our Mobile Messaging Competitor Leaderboard.

With the mobile messaging market placing an emphasis on conversational AI, Infobip’s substantial investment in the solution will be crucial to maintaining revenue in this volatile market.

Furthermore, Infobip scored well within the capacity & capability criteria, with the size of its operations, partnerships and range of industries served contributing to its strong positioning in this aspect.

Closely Followed by Vonage and Sinch…

Ranking second in the Mobile Messaging Competitor Leaderboard, Vonage’s APIs and AI Acceleration Suite allowed for its high scoring in product & positioning; however, overall it ranked second due to its lower capacity & capability.

Additionally, Sinch’s Smart Conversations, conversational messaging and RCS solutions provided the innovation and scope to position third it in the Competitor Leaderboard. With the volatility of the SMS platform, Sinch’s investment in RCS indicates its ability to capitalise on the changing conditions of the mobile messaging market.

Therefore, the investments that Infobip, Vonage and Sinch are making will maintain revenue potential in a highly changeable market.

How To Get Involved in Juniper Research’s Competitor Leaderboard

As part of the process to be included in Juniper Research’s Competitor Leaderboard, Juniper Research will send an RFI (Request for Information) and organise a briefing with the vendor, to gain both qualitative and quantitative information about the vendor’s solutions. This aids in scoring the leaderboard and constructing a vendor profile.

To register interest in participating in a future Competitor Leaderboard, click to visit our Competitor Leaderboard landing page: https://www.juniperresearch.com/services/competitor-leaderboards/

Latest research, whitepapers & press releases

-

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030Our Cross-border Payments research suite provides a comprehensive and in-depth analysis of the evolving cross-border payments landscape; enabling stakeholders such as businesses, financial institutions, payment service providers, card networks, regulators, and technology infrastructure providers to understand future growth, key trends, and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW

-

WhitepaperMarch 2026Telecoms & Connectivity

WhitepaperMarch 2026Telecoms & ConnectivityMWC 2026: What's Next for Mobile?

Our latest whitepaper distils the most important announcements from MWC Barcelona 2026 and examines what they mean for the telecoms market over the year ahead. From network APIs and 5G monetisation to AI-RAN, direct-to-cell connectivity, and 5G-Advanced, it explains where the biggest opportunities — and challenges — will emerge next.

VIEW -

WhitepaperMarch 2026Fintech & Payments

WhitepaperMarch 2026Fintech & PaymentsThe Transformation of Cross-border Payment Infrastructure

Our complimentary whitepaper, The Transformation of Cross-border Payment Infrastructure, examines the state of the cross-border payments market; explaining the role of key actors in transforming the cross-border payment experience, as well as the current landscape and recent developments within the cross-border payments industry.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW

-

Fintech & Payments

Top Three Global Leaders in Cross-border Payment Infrastructure Revealed

March 2026 -

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026