AWS Outage: Are Enterprises Overestimating Cloud Reliability?

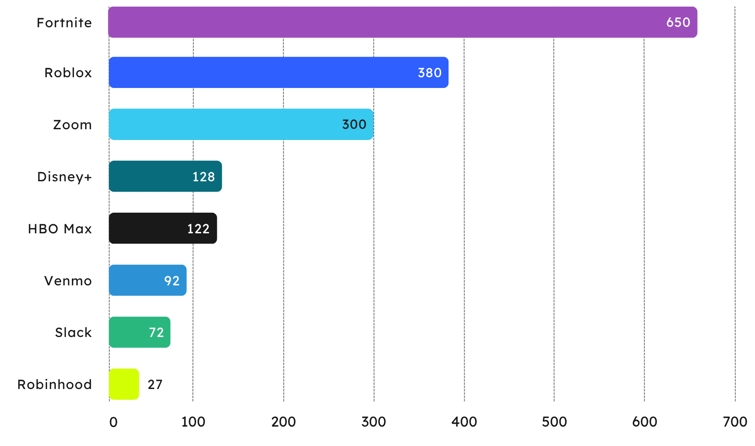

On October 20th, 2025, Amazon Web Services (AWS) experienced a substantial outage of its services in the US, with global impacts. The outage, caused by a domain name system (DNS) resolution failure that impacted a key database service, resulted in a cascading effect on AWS services. In turn, this led to many services that rely on AWS to also suffer outages; impacting consumers of various services including Disney+, Fortnite, HBO Max, Robinhood, Roblox, Slack, Venmo, and Zoom.

Estimated User Base for Select Service Providers Impacted by AWS Outage (m)

Source: Juniper Research

While AWS resolved the root cause of the issue within three hours, there were substantial impacts on various enterprises that leverage AWS. Despite the disruption, Amazon’s stock remained relatively stable; suggesting continued investor confidence in the company’s long-term market leadership. However, the incident could accelerate demand for multi-cloud orchestration tools, edge computing, and services that increase the overall resilience of cloud services. Overall, we expect the outage to initiate enterprises to explore new solutions or business models to increase the uptime of their services.

Is There an Overreliance on One Provider for Cloud Services?

The short answer is yes, we believe that there is an overreliance on many cloud services, notably AWS — which Juniper Research estimates to have a global market share of over 30%. As a company that has such a noteworthy presence in the market, it attracts the highest spending enterprises through significant degrees of redundancy within their operations to avoid scenarios like this. However, as is evident, no service is perfectly redundant, especially as the geographical reach of cloud services offered increases the complexity of network architectures. The larger the cloud service becomes, there is more within the service to fail, and a larger chance for cascading failures.

While AWS offers service credits for downtime, it does not cover the full operational and reputational costs. The event serves as a reminder that even leading cloud providers are not immune to large-scale disruptions.

Lessons are to be learned from this outage. Enterprises must not believe that services from AWS, and other leading providers such as Google and Microsoft, can be wholly relied upon, especially for enterprises that operate across multiple regions. The impacts of a failed DNS resolution must lead enterprises to explore multi-cloud strategies to increase redundancy and avoid vendor lock-in. Additionally, we recommend that enterprises implement their own monitoring software and not rely on the services provided by cloud providers.

The Financial Impact of AWS’s Outage

The financial impact of the outage is difficult to quantify at this stage, but we believe it will be significant. Many fintech services, such as Robinhood and Venmo, suffered downtime on their own platforms, which will likely lead to time spent on chargeback and dispute resolution, plus indirect costs of the outage. Similarly, digital platforms providers such as Disney+ and HBO Max suffered service interruptions; albeit for a small amount of downtime.

Aside from direct revenue loss from downtime, such as missed transactions and halted services, several indirect losses have resulted from this outage:

- Lost productivity for users of services such as Zoom or Slack. Many other enterprises rely on this for internal and external communication. This causes delays to AWS clients.

- Disrupted operations caused by the outage can also cause indirect costs through lost time. Key examples of this are enterprises in the healthcare or aviation industries that must be considered time-sensitive industries, where efficiency is key to maintaining profit; notably as profit margins can be small.

- Loss to brand reputation if services are down for substantial periods; leading to high levels of customer dissatisfaction. Essentially, this loss is unquantifiable, given the subjectivity and changes to opinion over time.

- Customer compensation, particularly in sectors like finance, travel, and telecoms, can add further costs through required refunds and service credits — as well as the unexpected time and resource needed to complete them.

How Must the Market Respond to this Outage?

It is reported that AWS’s service level agreements (SLAs) include 99.99% uptime for virtual servers, with discounts or credits to future services if AWS fails to meet these requirements. However, it's unlikely that these agreements cover lost enterprise revenue, productivity or reputational damage. Therefore, an enterprise’s choice of cloud service provider, or providers, must consider the impacts of this kind of outage. We believe that outages of any service are inevitable at some point.

Adopting a multi-cloud strategy will increase resilience and allow enterprises to mitigate the risks, direct costs, and indirect costs associated with these outages. A multi-cloud strategy will increase resilience and minimise the risk of extended periods of service downtime by enabling fallback onto a secondary service provider.

However, a key hurdle to enterprise adoption of multi-cloud strategies is the increased cost and complexity of implementation. For example, cloud service vendors will use a different suite of APIs, and security processes and functions are not interoperable between different platforms. Not only does this strategy lead to increased spend on cloud platforms, but additional training on the additional cloud service.

Outages such as this are a clear reminder that no service provider, regardless of reputation, scale or reach, can guarantee 100% uptime or provide complete protection against service downtime. While multi-vendor strategies will increase resilience, the high cost and interoperability challenges involved will likely exclude most cloud service users from adopting this strategy.

Indeed, we believe that cloud providers should embrace this challenge; providing solutions that are interoperable with other cloud platforms, including network APIs, to maximise the value of their solutions to enterprise users. After this outage, Juniper Research expects increased interest in a multi-cloud strategy, and platforms that can reduce spend and investment into integrating with additional systems will increase their value proposition to enterprises.

As VP of Telecoms Market Research at Juniper Research, Sam produces high-quality research on telecommunications technologies and the future of digital content. His recent reports include CPaaS, Direct-to-Cell, and 5G Future Strategies. Sam has been interviewed by leading media outlets, including the BBC and Wall Street Journal, and is a regular contributor to messaging conferences and telecommunications industry events.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Telecoms & Connectivity

Juniper Research Unveils 2026’s Telecoms & Connectivity Award Winners

January 2026 -

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026