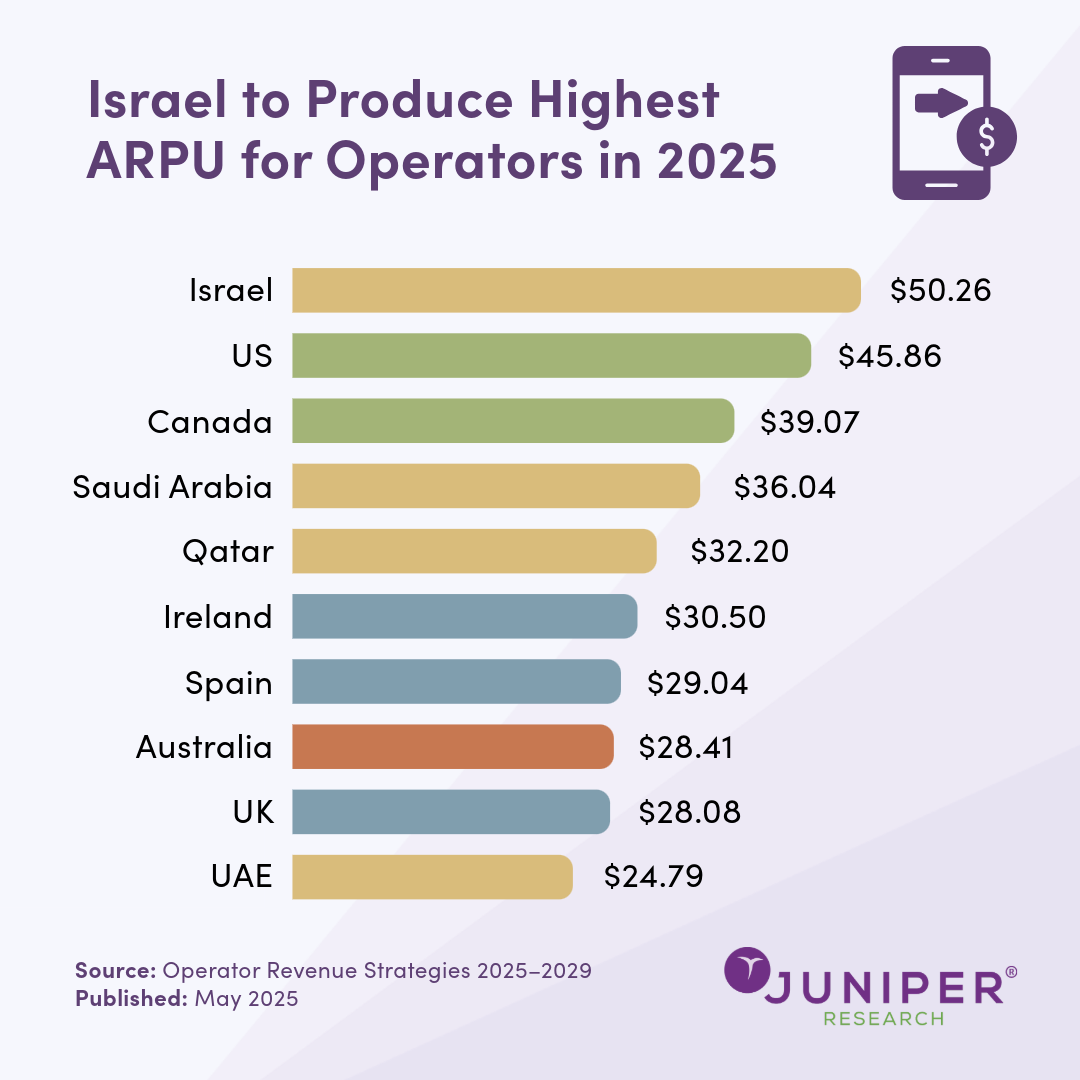

Understanding Mobile ARPU: Top 10 Countries in 2025

Average Revenue Per User (ARPU) is a key metric for mobile operators - but as evidenced in the above infographic, it can look very different depending on where in the world you are. So why do some countries report much higher ARPU than others?

Income levels and spending power

In high-income countries, users are more likely to pay for premium plans, data-heavy services, and value-added features. In contrast, operators in lower-income markets often rely more on prepaid customers and lower-cost plans, which naturally bring in less revenue per user.

Market competition

In highly competitive markets, price wars and aggressive discounting can drive ARPU down. Where there are only a few dominant players, operators may have more pricing power and maintain higher ARPU levels.

Prepaid vs. postpaid usage

Countries with a strong postpaid culture - like the US or Japan - typically see higher ARPU due to longer contracts and bundled services. In contrast, markets dominated by prepaid users, such as many in Africa or South Asia, often see lower average revenue.

Mobile service adoption

In some regions, mobile users rely on basic voice and SMS services, while in others, demand for high-speed data, streaming, and mobile payments is much higher. The types of services customers use has a direct impact on ARPU.

Regulation and taxation

Local policies and taxes can also influence pricing strategies. Strict price controls or high taxes on telecom services can limit what operators can charge - and therefore affect ARPU.

In short, ARPU isn’t just a measure of individual user value; it’s a reflection of economic, cultural, and regulatory conditions in each market. That’s why it’s so important to look at it in context when comparing across countries.

Source: Operator Revenue Strategies 2025–2029

Download the Whitepaper: 3 Key Emerging Revenue Streams for Operators

Read the Press Release: Mobile Network Operators’ Enterprise Revenue to Reach $348bn by 2029

Latest research, whitepapers & press releases

-

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030Our Cross-border Payments research suite provides a comprehensive and in-depth analysis of the evolving cross-border payments landscape; enabling stakeholders such as businesses, financial institutions, payment service providers, card networks, regulators, and technology infrastructure providers to understand future growth, key trends, and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW

-

WhitepaperMarch 2026Telecoms & Connectivity

WhitepaperMarch 2026Telecoms & ConnectivityMWC 2026: What's Next for Mobile?

Juniper Research's MWC 2026 whitepaper reveals the most exciting technology advancements announced at the conference this year, as we enter 'The IQ Era'; where intelligence is becoming integral to mobile networks. Featuring five key takeaways, the whitepaper covers trends across network APIs, 5G monetisation strategies, AI-RAN, direct-to-cell, and 5G-Advanced. It delivers Juniper Research's expert insights into what the market can expect over the next twelve months.

VIEW -

WhitepaperMarch 2026Fintech & Payments

WhitepaperMarch 2026Fintech & PaymentsThe Transformation of Cross-border Payment Infrastructure

Our complimentary whitepaper, The Transformation of Cross-border Payment Infrastructure, examines the state of the cross-border payments market; explaining the role of key actors in transforming the cross-border payment experience, as well as the current landscape and recent developments within the cross-border payments industry.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW

-

Fintech & Payments

Top Three Global Leaders in Cross-border Payment Infrastructure Revealed

March 2026 -

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026