The Future of Payments: What’s Powering the A2A Boom?

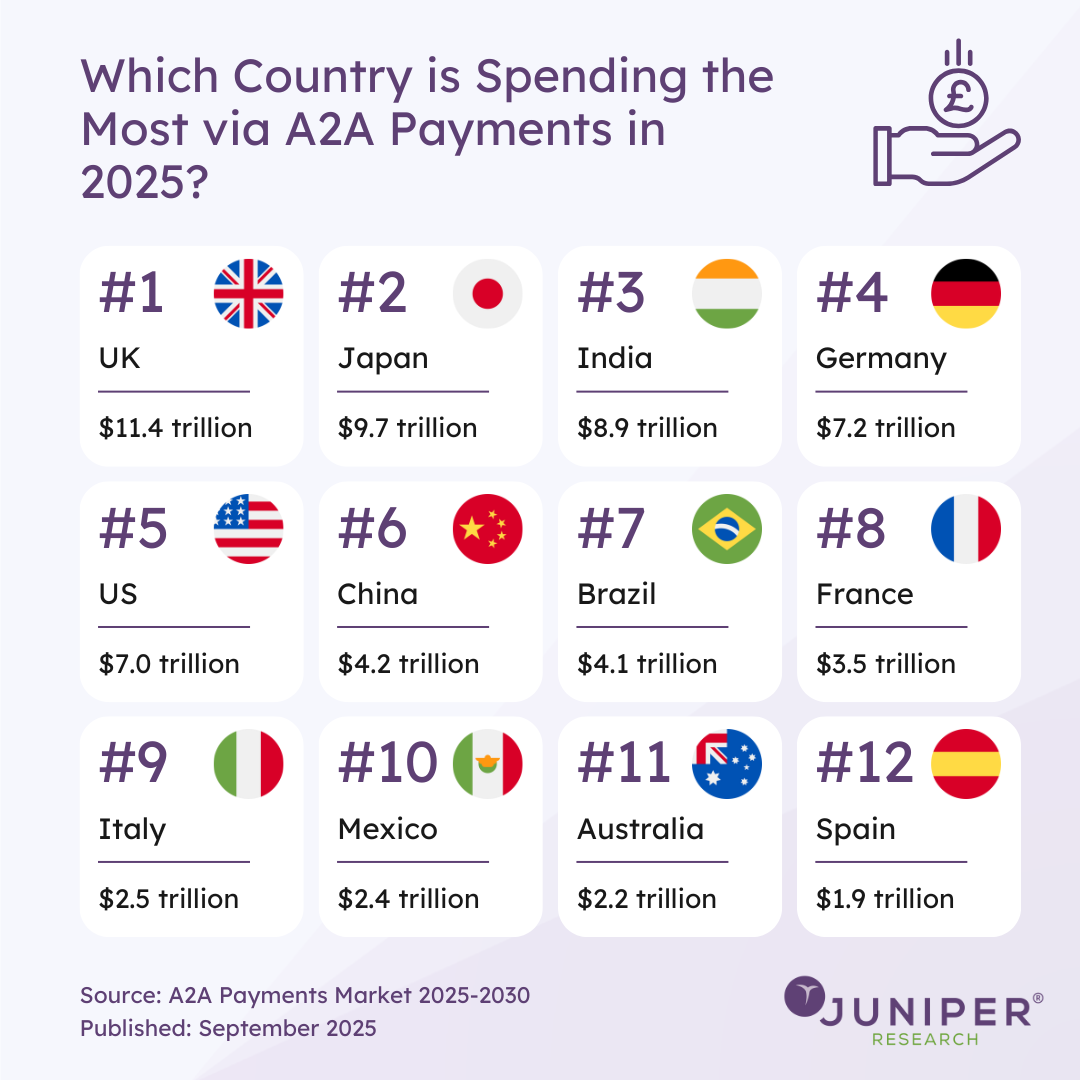

Account-to-Account (A2A) payments are no longer a niche option. By 2025, spending via A2A will hit staggering levels – with the UK leading the way at $11.4 trillion, followed closely by Japan and India. But what’s behind this rapid rise? Several factors are converging to make A2A payments one of the most significant shifts in financial services today.

The Role of Technology

Smartphones have become the backbone of modern finance, enabling consumers to send and receive money with just a few taps. Features such as biometric authentication and QR code scanning make A2A payments seamless, while app-based requests simplify everything from peer-to-peer (P2P) transfers to online shopping.

Artificial intelligence is also reshaping the landscape. AI-driven fraud detection, behavioural biometrics, and automated verification processes mean that A2A payments are now both more secure and more convenient. This combination of speed and safety is essential for winning consumer trust.

Government Initiatives and Regulation

National payment schemes have been instrumental in driving adoption. India’s UPI and Brazil’s Pix are prime examples of how government-backed infrastructure can revolutionise everyday payments. Similarly, the EU’s adoption of ISO 20022 has set global standards for interoperability, making it easier for businesses and consumers to embrace A2A.

Meanwhile, Open Banking initiatives are unlocking new possibilities such as Variable Recurring Payments (VRPs), which give consumers more control over subscriptions and regular payments. This level of regulatory support is pushing A2A into the mainstream across multiple regions.

Lower Costs, Better Cash Flow

For businesses, one of the biggest draws is cost. Traditional wire transfers can be expensive, with fees ranging from $0 to $50 per transaction in the US, plus hefty surcharges on international transfers. By contrast, A2A payments via systems like FedNow can cost just a few cents per transaction.

By cutting out intermediaries such as card networks, A2A payments help businesses manage cash flow more effectively. Funds settle instantly, reducing reconciliation delays and operational costs. For consumers, these savings often translate into lower fees and smoother payment experiences.

Expanding Financial Inclusion

A2A payments are also helping to close the financial inclusion gap. In emerging markets, QR code–based payments allow even small businesses or unbanked individuals to participate in digital commerce with nothing more than a smartphone and internet access.

By lowering barriers to entry, A2A is enabling broader participation in digital financial systems. This not only benefits individuals in remote or underserved communities but also supports local economic development.

Building Consumer Trust

Security remains central to A2A adoption. Strong Customer Authentication (SCA) requirements, combined with multi-factor authentication, have dramatically reduced fraud rates. Enhanced transparency – such as real-time confirmation of payment transfers – further builds user confidence.

Providers are also innovating with refund processes and protections, ensuring that consumers feel as secure with A2A as they do with card-based payments.

Source: A2A Payments Market 2025-2030

Read the Press Release: A2A Transaction Value to Reach $195 Trillion in 2030 Globally, Driven by Advanced Value-added Services

Download the Whitepaper: Ascending-to-Ailing: The Deceleration of A2A Adoption

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026