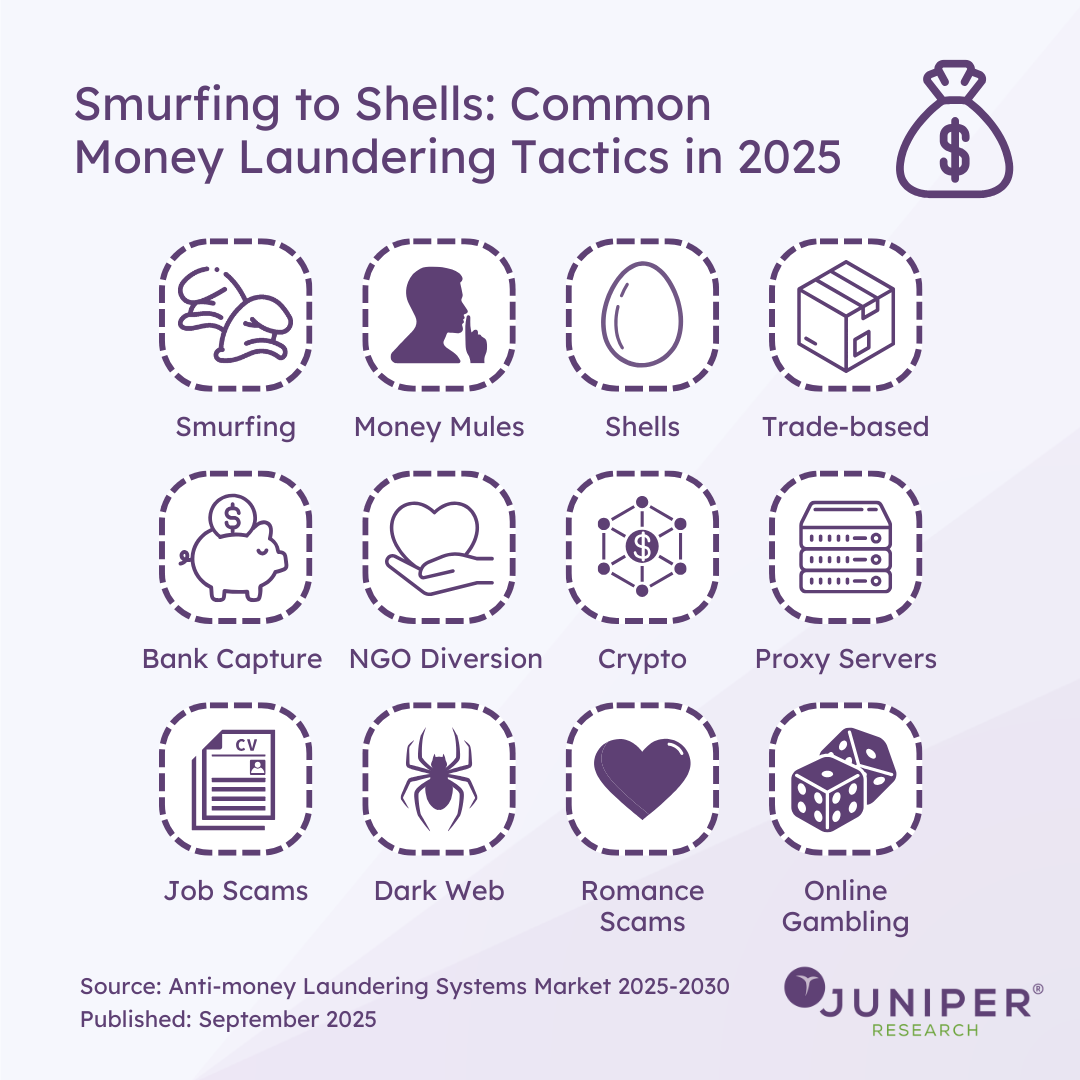

Inside the Launderer’s Toolkit: How Criminals Clean Dirty Money in 2025

As global regulations tighten and financial systems become more digital, money launderers are evolving their methods to stay one step ahead. Our latest research on the subject has identified 12 tactics most likely to dominate in 2026 — a mix of old-school deception and cutting-edge digital manoeuvres.

Smurfing

Named after the small blue cartoon characters, smurfing involves splitting large sums of money into smaller, seemingly harmless deposits to avoid detection. Rather than one suspicious transaction, criminals scatter hundreds of micro-deposits across multiple accounts. It’s low-tech but surprisingly effective, especially in markets where banks still rely on manual oversight for smaller transfers.

Money Mules

Money mules are the unwitting middlemen of the laundering world. They’re recruited—often through social media or job ads—to transfer money through their accounts, under the pretence of legitimate employment. Some know what they’re doing; many don’t. Either way, the result is the same: dirty money appears to move through a clean individual’s hands.

Shells

Shell companies are hollow corporate entities—businesses that exist on paper but do little or no real trading. They’re perfect for masking ownership and moving funds under the guise of legitimate business activity. From offshore tax havens to complex multi-jurisdictional structures, shells remain one of the most enduring tools for hiding illicit wealth.

Trade-based Laundering

This method dresses financial crime up as global commerce. Criminals manipulate trade invoices—overstating or understating prices, faking shipments, or disguising the nature of goods—to move value across borders. The sheer complexity of international trade makes this a challenge to detect, even for advanced compliance systems.

Bank Capture

In some cases, criminals take the boldest route possible: they capture the bank itself. By infiltrating or outright controlling smaller, poorly regulated financial institutions, they gain direct access to systems that can legitimise illicit funds. Once inside, transactions can be masked, records altered, and oversight quietly neutralised.

NGO Diversion

Non-governmental organisations are built on trust—something money launderers exploit. By routing illegal funds through charities or aid projects, criminals can make their money appear as philanthropic support. In regions affected by conflict or disaster, where financial oversight is limited, this tactic is particularly difficult to uncover.

Crypto

Cryptocurrencies have opened a new frontier for financial crime. Their decentralised, pseudonymous nature allows launderers to move funds quickly across borders without banks or regulators in the way. Sophisticated criminals use mixers and privacy coins to further obscure transaction trails, challenging even the most advanced AML systems.

Proxy Servers

Not all laundering is financial—sometimes it’s digital camouflage. By routing activity through multiple proxy servers or VPNs, criminals can disguise their online identities and locations. This makes it far harder for investigators to connect suspicious financial movements to real-world individuals or organisations.

Job Scams

A new twist on an old con, job scams lure victims with fake employment offers—often in “payment processing” or “financial coordination.” The catch? These workers are actually laundering money for criminals without realising it. Once authorities trace the activity, the “employee” is left carrying the blame.

Dark Web

The dark web remains a thriving ecosystem for illicit trade. From stolen data to illegal substances, everything has a price—and nearly all transactions are in cryptocurrency. Money launderers use dark web markets to mix, move, and disguise their funds, often layering transactions across multiple wallets to throw off digital investigators.

Romance Scams

Few tactics are as emotionally manipulative as romance scams. Fraudsters build online relationships with victims, then invent emergencies or business opportunities to extract money. In some cases, they go further—asking victims to transfer funds on their behalf, turning them into unwitting accomplices in laundering operations.

Online Gambling

Casinos and betting sites—especially unregulated ones—offer the perfect front for laundering. Criminals deposit dirty money as betting funds, place a few strategic wagers, then withdraw their balance as “winnings.” It’s an elegant disguise, with the added benefit of plausible deniability.

As regulators and AML systems adapt, one thing is clear: financial crime is a moving target. Understanding how these tactics work is the first step towards staying ahead of those who aim to exploit the system.

Source: Anti-money Laundering Systems Market 2025-2030

Read the Press Release: AML Systems Market to Surpass $75 Billion by 2030 Globally, With LexisNexis Risk Solutions, Oracle, and Experian Leading the Defence

Download the Whitepaper: From Detection to Prevention: The Next Era of Anti-money Laundering

Latest research, whitepapers & press releases

-

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW -

ReportNovember 2025Fintech & Payments

ReportNovember 2025Fintech & PaymentsModern Card Issuing Platforms Market: 2025-2030

Our Modern Card Issuing Platforms Market research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from banks, financial institutions, fintech companies, and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW

-

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW -

WhitepaperNovember 2025Fintech & Payments

WhitepaperNovember 2025Fintech & PaymentsUnlocking the Next Stage of Growth for Modern Card Issuing Platforms

This free whitepaper analyses key trends shaping the modern card issuing space, and the ways in which modern card issuing platforms can capture growth.

VIEW

-

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026 -

IoT & Emerging Technology

Juniper Research Unveils Top 10 Emerging Tech Trends to Watch in 2026

January 2026 -

Fintech & Payments

Digital Identity App Usage to Hit 6.2 Billion by 2030, Driven by Shift to Decentralised Models

December 2025 -

Telecoms & Connectivity

Travel eSIM Margins Under Pressure as Revenue per Gigabyte Falls 10% Globally in Two Years

December 2025 -

Telecoms & Connectivity

AI Agents to Power 1,000% More Customer Interactions for Enterprises Globally by 2027

December 2025