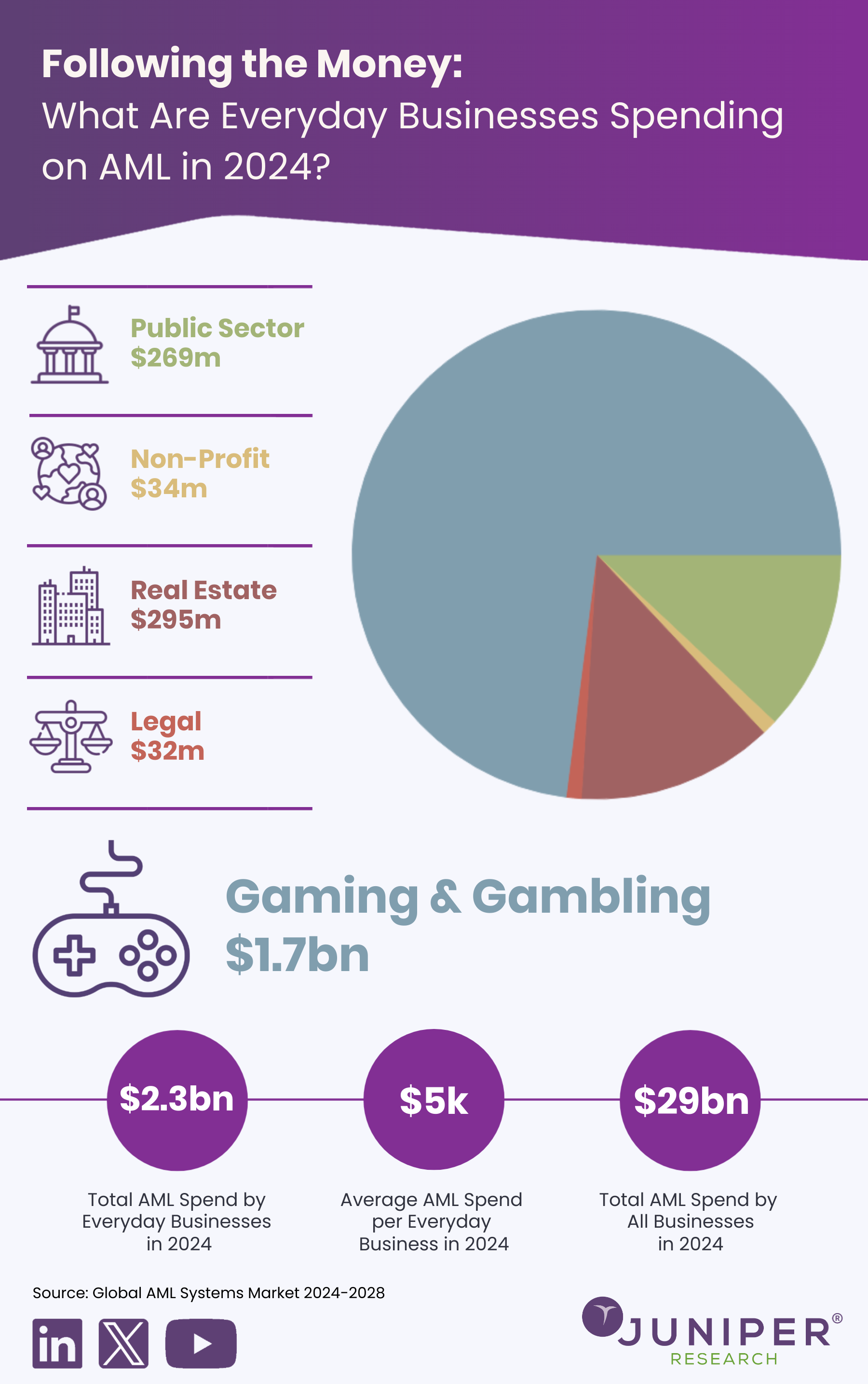

Following the Money: What Are Everyday Businesses Spending on AML in 2024?

When discussing anti-money laundering systems, most focus is paid towards its role in large financial institutions such as banks, insurers, and lenders. However, anti-money laundering is a vital element of any business that deals with financial transactions.

Our latest research has identified five everyday segments where anti-money laundering systems are finding an audience, ranging from professional services businesses to everyday entertainment. The above infographic summarises how much each of each segments will spend on anti-money laundering systems this year – but what opportunities and challenges need to be overcome for this spend to happen?

Public Sector

AML systems in the public sector provide an opportunity to maintain public trust, protect resources, and prevent financial crimes, but managing compliance is complex due to diverse regulations, stakeholder expectations, and limited resources. Challenges include underfunding, resistance to change, and the need for a culture of compliance to overcome barriers to effective implementation.

Non-profits

The expanding need for AML systems in charities aims to address genuine financial and reputational risks, including inadvertent involvement in money laundering. Challenges such as money laundering through anonymous donations complicate risk assessment, yet implementing robust AML measures is crucial for maintaining the integrity and stability of non-profit organizations.

Real Estate

Real estate presents opportunities to strengthen AML efforts through asset declaration requirements, empowering professionals to act as gatekeepers, and establishing centralized land registry systems. Challenges include the attractiveness of real estate to criminals, lack of transparency, and limited regulatory oversight, necessitating robust measures to combat money laundering effectively.

Legal

AML systems in the legal sector offer opportunities to monitor and flag risks, particularly concerning large organized crime, while addressing challenges such as abuse of client accounts and accurate management of customer relationships. Investing in AML systems can foster transparency and public confidence in legal services.

Gaming and Gambling

The gaming and gambling industry faces significant opportunities and challenges in implementing AML measures, given its vulnerability to financial crime and regulatory frameworks. Effective guidelines include KYC procedures and addressing gambling addiction through behavioral analytics. Challenges include underage gambling and regulatory amendments, emphasizing the need for stringent measures to prevent money laundering and terrorist financing.

Source: Global AML Systems Market 2024-2028

Download the Whitepaper: Top 3 Uses of AI in AML

Read the Blog: Money Laundering in the Digital Age

Latest research, whitepapers & press releases

-

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030Our Cross-border Payments research suite provides a comprehensive and in-depth analysis of the evolving cross-border payments landscape; enabling stakeholders such as businesses, financial institutions, payment service providers, card networks, regulators, and technology infrastructure providers to understand future growth, key trends, and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW

-

WhitepaperMarch 2026Telecoms & Connectivity

WhitepaperMarch 2026Telecoms & ConnectivityMWC 2026: What's Next for Mobile?

Our latest whitepaper distils the most important announcements from MWC Barcelona 2026 and examines what they mean for the telecoms market over the year ahead. From network APIs and 5G monetisation to AI-RAN, direct-to-cell connectivity, and 5G-Advanced, it explains where the biggest opportunities — and challenges — will emerge next.

VIEW -

WhitepaperMarch 2026Fintech & Payments

WhitepaperMarch 2026Fintech & PaymentsThe Transformation of Cross-border Payment Infrastructure

Our complimentary whitepaper, The Transformation of Cross-border Payment Infrastructure, examines the state of the cross-border payments market; explaining the role of key actors in transforming the cross-border payment experience, as well as the current landscape and recent developments within the cross-border payments industry.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW

-

Fintech & Payments

Top Three Global Leaders in Cross-border Payment Infrastructure Revealed

March 2026 -

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026