Buy Now Pay Later vs. Credit Cards: How Do They Compare in 2024?

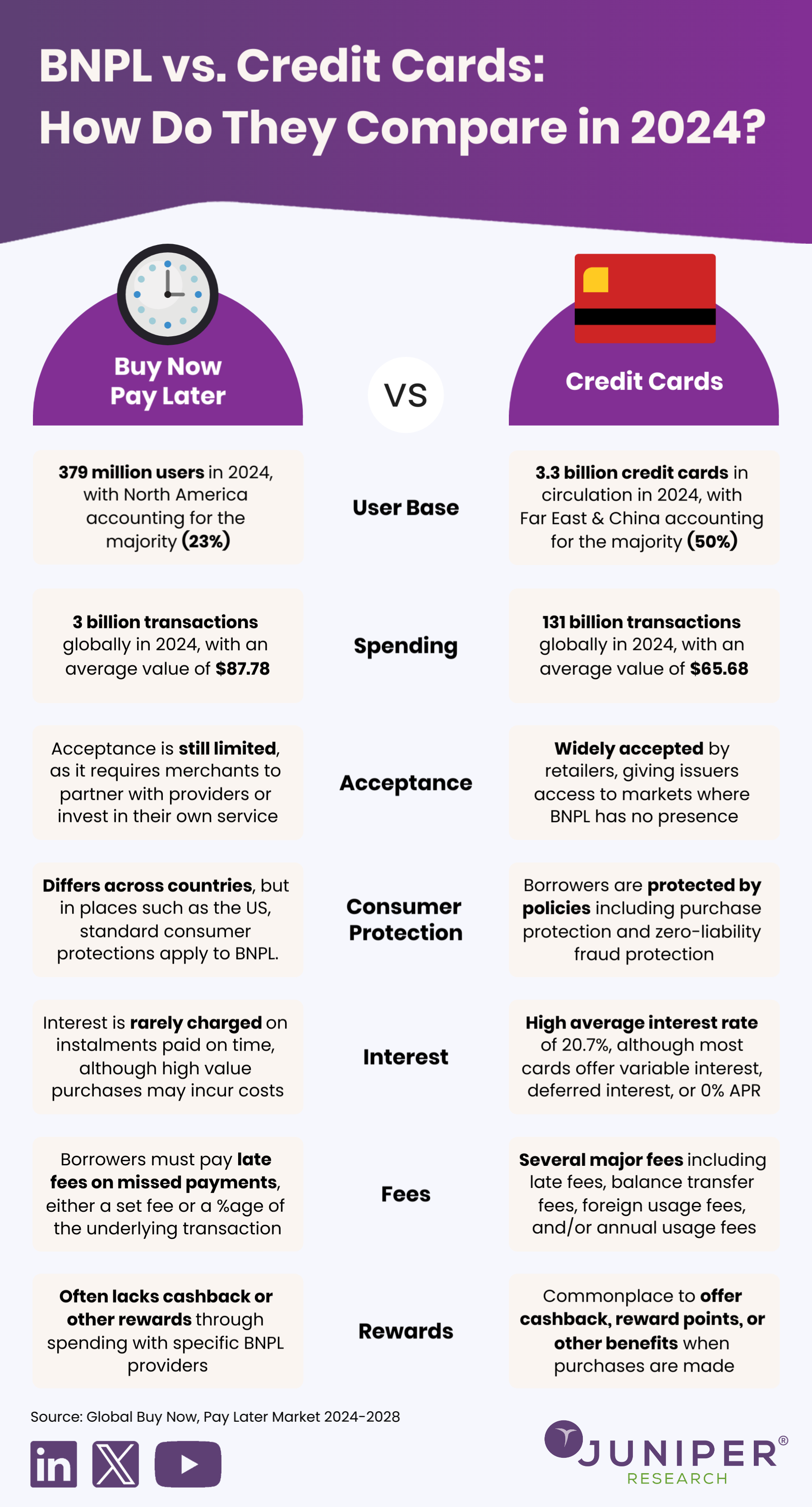

Since the emergence of Buy Now Pay Later (or BNPL), there has been an ongoing debate about how it compares with traditional forms of borrowing – particularly credit cards. As the above infographic illustrates, there are plenty of advantages, disadvantages, and nuances to each payment method.

However, this debate may soon be rendered meaningless, given the gradual intertwining of traditional credit with BNPL. In recent years, most leading credit card companies – including Visa and Mastercard - have launched their own successful BNPL offerings, at the expense of established BNPL players such as Klarna and Afterpay.

These offerings not only enable banks and fintech companies to offer BNPL through shared rails, but enable consumers’ credit cards to function like BNPL. There are good examples of this:

- Chase Bank’s My Chase Plan, which enables consumers pay off purchases of $100 or more in monthly interest-free instalments for a fee.

- Citibank’s Citi Flex Pay, whereby purchases over $75 can be paid off in fixed payments for no fee, but with a fixed interest rate. These are also offered separately from the cards’ credit limits, meaning that borrowers still retain their usual traditional credit.

The success of these offerings comes from their approach of offering BNPL as a feature of the credit card, as opposed to being a wholly new product that exists outside of the card network like ‘traditional’ BNPL. On one hand, this adds additional fees and more rigorous (‘hard’) credit checks to what was previously a very laissez-faire process, but on the other, means borrowers benefit from consumer protection rules that traditionally didn’t apply to BNPL.

The success of these diverse approaches is yet to be fully understood, and only time will tell whether these offerings are successful because they offer something that Klarna, Afterpay, Zip et al. are failing to offer consumers – or whether, by virtue of being household names, they’re viewed as being a more ‘responsible’ version of BNPL.

Source: Buy Now Pay Later Market 2024-2028

Latest Press Release: BNPL Transaction Value to Rise 106% Globally by 2028; Catalysed by Regulatory Breakthroughs and Increased B2B Use

Download the Whitepaper: Buy Now, Problems Later? The Challenges of BNPL

Read the Blog: Buy Now Pay Later Fraud: A Growing Risk for Loan Providers

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026