What Google Dropping SMS OTPs Means for Mobile Identity

Google has just shaken up its Gmail login process by announcing the removal of SMS one-time passwords (OTPs), replacing them with QR codes for identity verification. Given growing concerns over the security and cost of SMS OTPs, the move makes sense — but the switch to QR codes caught many off guard.

It’s worth noting that this update won’t affect everyone. Many users already rely on more secure options like passkeys or the Google Authenticator app, and they’ll continue to do so. The change primarily targets those still using SMS OTPs, which have long been criticised for their vulnerability to phishing and interception.

So, why now — and why QR codes?

Why Switch Now?

SMS OTPs have experienced high levels of fraudulent activity recently, impacting all stakeholders in the value chain, including mobile subscribers, enterprises and mobile operators. Fraudulent activity such as artificially inflated traffic (AIT) and SMS trashing attempts have led to diminishing trust in SMS as an authentication method; leaving stakeholders to seek alternative methods to verify their users. AIT and SMS trashing occurs when fraudulent players generate many fake accounts on a legitimate enterprise’s website, prompting two-factor authentication and thus a significant number of OTPs to be sent via SMS.

Additionally, the cost of A2P SMS has risen considerably in the last couple of years, with A2P SMS costs almost doubling in some regions. This has made authentication particularly costly for enterprises, with the combination of these increased costs and high levels of fraudulent activity intensifying the need for new forms of mobile identity.

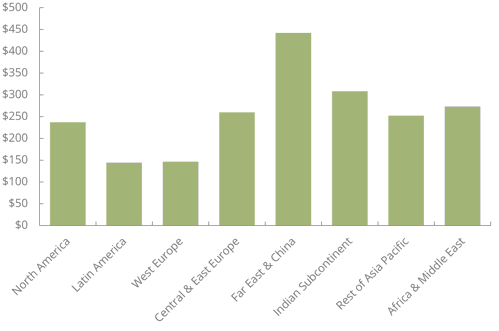

Total Cost of AIT and SMS Trashing to Enterprises ($m) in 2024

Source: Juniper Research

Google’s decision, therefore, to replace SMS OTPs in their Gmail authentication processes is not a surprise, despite the dominance of SMS OTPs within mobile identity, and we anticipate that many enterprises and organisations will follow in this development.

Are QR Codes the Answer?

While Google’s switch from SMS OTPs for Gmail was an entirely expected move, the announcement that QR codes would be the new method to authenticate a user was less anticipated. QR codes have numerous benefits, including enhanced security through the requirement for the user to be present to scan the QR code, as well as removing the need for users to memorise often complex passwords. Furthermore, QR codes enable quick authentication and require little infrastructure from the enterprise; making them cost-effective. These benefits make them a viable alternative to the previously dominant SMS OTPs.

However, there are limitations when considering QR codes for mobile identity. The use of QR codes assumes a level of technology that not all users may have, as it depends on the user having a smartphone or device with camera and scanning capabilities. Also, it presumes that most users will be accessing their Gmail account on an alternative device from the one that is being used to scan the QR code, which with the demand for access to accounts on the go is unlikely. Therefore, the use of QR codes for mobility identity by Google risks alienating some users.

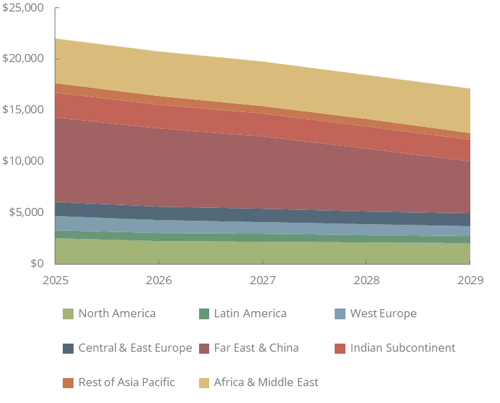

This switch exemplifies a wider market dynamic, with the issues surrounding SMS OTPs also prompting other organisations to follow a similar trend to Google. The consequence of this will be felt most significantly by mobile operators, who (as per our recent forecasts) received $22.3 billion in SMS OTP revenue globally in 2024. Stakeholders moving away from SMS OTPs as a mobile identity solution to non-operator billed methods provides a substantial threat to future mobile operator revenue streams.

Total Operator-billed Revenue from SMS OTPs ($m), Split by 8 Key Regions, 2025-2029

Source: Juniper Research

So, What's the Future of Mobile Identity?

Given Google’s significant investment and role in the development of rich communication services (RCS), Juniper Research was surprised that Google had opted for QR codes for Gmail authentication. Similar to SMS, RCS can be used for OTPs in authentication, and with Google’s involvement in the development of RCS, it would have seemed a natural progression to implement RCS OTPs into Gmail authentication methods.

RCS offers numerous advantages for mobile identity when compared to SMS, with RCS providing enhanced security through verified sender profiles and branded messaging capabilities. However, the lack of established reach with RCS proves to be a complexity in utilising it for mobile identity, with many mobile operators not yet supporting the messaging platform.

RCS has capabilities extending further than OTPs, with it enabling richer communications between enterprises and customers such as two-way conversations and enhanced graphics and images. Therefore, the developmental and commercial focuses for RCS were centred around marketing and conversational use cases, rather than OTPs.

Additionally, over the top (OTT) messaging platforms such as WhatsApp have a wide reach and are already utilised by some enterprises for OTP use cases, however with this service being provided by one of Google’s rivals, Meta, it explains why Google have not opted for this service for authentication.

In summary, Google’s decision to move away from SMS OTPs responds to the concerns surrounding SMS as an authentication channel, but there is yet to be a clear successor within mobile identity; with a range of options being explored by enterprises. In turn, Juniper Research’s recent mobile identity study predicted that application programming interfaces (APIs) which authenticate users silently in the background of the device, by utilising the mobile network, will replace SMS as the dominant form of mobile identity. This owes to the high level of security that silent authentication APIs offer and the user friendliness provided with a lack of user interaction.

Georgia is a Research Analyst in Juniper Research’s Telecoms & Connectivity team, providing analysis on the emerging trends and latest developments in the telecommunications market. Her recent reports include Mobile Identity, AIT Prevention, and Robocall Mitigation & Branded Calling.

Latest research, whitepapers & press releases

-

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030Our Cross-border Payments research suite provides a comprehensive and in-depth analysis of the evolving cross-border payments landscape; enabling stakeholders such as businesses, financial institutions, payment service providers, card networks, regulators, and technology infrastructure providers to understand future growth, key trends, and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW

-

WhitepaperMarch 2026Telecoms & Connectivity

WhitepaperMarch 2026Telecoms & ConnectivityMWC 2026: What's Next for Mobile?

Our latest whitepaper distils the most important announcements from MWC Barcelona 2026 and examines what they mean for the telecoms market over the year ahead. From network APIs and 5G monetisation to AI-RAN, direct-to-cell connectivity, and 5G-Advanced, it explains where the biggest opportunities — and challenges — will emerge next.

VIEW -

WhitepaperMarch 2026Fintech & Payments

WhitepaperMarch 2026Fintech & PaymentsThe Transformation of Cross-border Payment Infrastructure

Our complimentary whitepaper, The Transformation of Cross-border Payment Infrastructure, examines the state of the cross-border payments market; explaining the role of key actors in transforming the cross-border payment experience, as well as the current landscape and recent developments within the cross-border payments industry.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW

-

Fintech & Payments

Top Three Global Leaders in Cross-border Payment Infrastructure Revealed

March 2026 -

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026