Touch and Go: Will Biometric Payment Terminals Succeed?

Biometric authentication has already reshaped payments, from fingerprint-enabled smartphones to biometric payment cards. Now, the next step is cutting out the middleman entirely - paying with just a touch or a glance. But can vendors win over consumers wary of privacy risks and data security concerns?

Source: Juniper Research

Source: Juniper Research

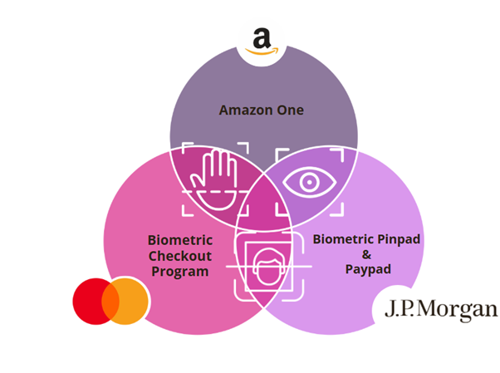

We take a deep dive into three major players trialing this technology - a tech giant, a leading bank, and a global card network - while uncovering the challenges they need to overcome to succeed.

Mastercard

Mastercard has announced a biometric checkout programme that allows consumers to smile into a camera or wave their hand over a reader to pay. The first pilot was launched in five Brazilian supermarkets in 2022, with future pilots planned for roll-out in the Middle East and Asia region. Similarly, Visa and PopID, a consumer authentication service provider based on facial identity, partnered to launch a facial ID service for companies in the Middle East.

Source: PopID

It is notable that these innovations by the card networks are focusing on Latin America, and the Middle East and Asia region; suggesting these corporations believe these regions will be the most receptive to biometric innovations. This may be due to existing biometric systems for national identification, such as biometric voter registration systems, which create consumer familiarity with the technology. While there are no European users, almost half of the countries in Africa and Latin America use these systems. This, along with stricter regulations in the European Union regarding biometric data, suggests that Western Europe may be one of the last regions to experience biometric payments.

Mastercard has announced that their technology will be governed by their principles for data responsibility, which assert that consumers should control and own their personal data. However, without wider regulations to enforce these rules, consumers may not be reassured.

JPMorgan

JPMorgan has announced a roll-out of biometric payment terminals in the second half of 2025, in the US, also in partnership with PopID. These are designed to accept a wide range of payments, including contactless, QR code and biometric identification, enabling ‘Pay by Smile’ to complete transactions seamlessly. JPMorgan is aiming this at quick-service restaurants, event venues, and grocery stores in the US.

Source: JPMorgan

This represents the first step by major banks into developing biometric terminals, which is a logical move as customers already trust banks to safeguard their payment data. Merchants may be more willing to adopt payment solutions pushed by banks rather than private corporations, as banks have a long-established reputation for fraud protection.

Amazon

Amazon has introduced a biometric retail payment technology in all of its Whole Foods stores in the US, called Amazon One. This is a palm recognition solution allowing users to pay, enter, or identify themselves. In the last year, Amazon One has launched an app to simplify palm recognition sign-up; letting users sign up by taking a picture of their palm and adding a payment method.

According to Amazon, the service has been used over 8 million times since its launch in 2021 up until 2024.

Source: Amazon

While Apple and Samsung store their biometric data in the user’s device, Amazon is unique in that it stores palm data in the AWS cloud. This has raised concerns amongst US Senators about the safety of this encryption method. After all, if credit and debit card information is hacked, the card can be replaced; your palm cannot. However, Amazon has sought to address these privacy concerns by using temporary digital signatures which can be matched to the data and deleted in the case of hacking. According to Amazon, the palm data is not used for direct, one-to-one mapping (as seen with systems such as Apple Pay), but rather to link the data to a specific user account.

To enhance security, Amazon has implemented liveness detection to prevent spoofing and ensure that palm data is unmatchable with data from other sources; making it useless to third parties. These measures are vital for companies like Amazon; guaranteeing that even if the company was to relax its data-selling policies, the palm data could not be tied to a user’s identity beyond its intended use, such as linking it to a shopping account. This approach not only protects users' privacy but also helps to build and maintain trust in Amazon's biometric authentication system.

Future Outlook

Juniper Research believes biometric payments have huge potential in retail - but there are key hurdles to clear first.

Shoppers are growing frustrated with juggling multiple apps and loyalty cards just to access discounts. Seamlessly linking accounts to payment methods would be a game-changer in convenience.

However, adoption won’t happen overnight. Merchants must invest in new hardware and integrate it into existing systems, slowing the rollout. As a result, expect to see biometric terminals first appear in high-profile retailers looking to lead the charge in customer-centric innovation.

Lorien is a Research Analyst in the Fintech and Payments team at Juniper Research, and specialises in analysing and forecasting emerging trends and innovations in financial markets. Her latest reports have covered topics including Virtual Cards, Network Tokenisation, and CBDCs & Stablecoins.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026