The Future of Business Messaging: Apple Confirmed to Support RCS Business Messaging in Autumn

On 25th April 2024, I represented Juniper Research at the latest MEF CONNECTS Business Messaging event in London by presenting our latest A2P messaging research as a keynote presentation. This presentation was entitled ‘The Messaging Mix: Navigating the Future of SMS, RCS and OTT’, and discussed the key themes disrupting the messaging market over the last 12 months. These included:

- The rising price of SMS termination, due to competition from third-party messaging apps, such as WhatsApp, meant that mobile operators increased the price of SMS traffic to try and recover lost revenue. However, these high prices only created an attractive revenue opportunity for fraudsters; resulting in the growth of AIT (Artificially Inflated Traffic).

- WhatsApp’s recent price increase for international authentication use cases in India and Indonesia will put pressure on enterprises and will reduce the attractiveness of WhatsApp as a business messaging channel in these markets; creating an opening for RCS.

The presentation also included key recommendations on how to optimise the future of the messaging market, which included:

- With a reduction in business messaging traffic being delivered across the SMS channel, communications APIs (Application Programmable Interface) will provide a key alternative for SMS, as it will keep demand for SMS use cases, such as one-time passwords and multi factor authentication, on the operator network, thus maintaining some lost revenue.

- The growing revenue potential from SMS will result in an increase in the number of fraudsters trying to make a profit from the channel. Technological advancements in AI and machine learning mean that they will be an important technology for detecting and eliminating fraud across SMS.

- The increased publicity surrounding RCS (following Apple’s announcement) will result in a growing number of operators supporting RCS, and this rise in RCS will increase the opportunities for RCS Business Messaging. Additionally, as brands can be verified through the RCS channel, this enables consumers to have a greater trust in messages they receive from brands. This will drive RCS to account for over 23% of business messaging traffic by 2028.

For more insights and recommendations, please download the full slide deck by clicking HERE.

During this same event, many presentations and panels were given by a number of technology providers and global enterprise brands including BT, Rakuten Viber, XConnect, and Mitto with key themes such as the proliferation of AI in the messaging ecosystem, the need for security and verification processes and the future imminent growth of RCS were discussed.

Source: Mobile Ecosystem Forum

Big News for RCS Business Messaging!

With that, the big news came when Tim Atkinson (Business Development at Google) announced that Apple will be supporting RCS Business Messaging as well as P2P (Person-to-Person) RCS messaging in the autumn. Before this event, Apple had announced that it would support the Universal Profile for RCS on iOS devices in a software update that will begin in 2024. However, there was still much speculation in the industry around whether Apple would also provide the same support for RCS Business Messaging and when this support would be announced.

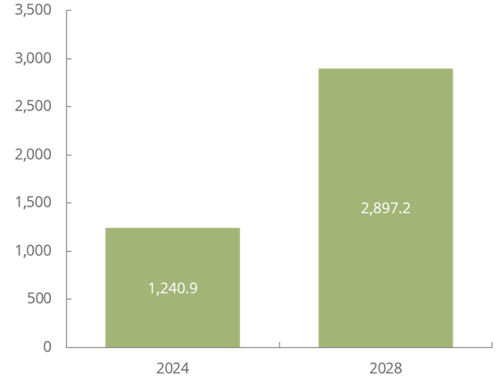

Following the confirmation of both Apple’s and Google’s support of RCS Business Messaging this year, we anticipate that the total number of RCS-active subscribers will rise from in 1.2 billion in 2024 (primarily with support from Google), to 2.9 billion in 2028 (following this additional support from Apple).

Source: Juniper Research

It is not just this support from Apple and Google that will generate a growth in RCS Business Messaging traffic. RCS has several benefits over its predecessor SMS, as enterprises leveraging the RCS channel can send branded messages and rich media.

However, during a panel discussion at this event, it was proclaimed that, for enterprises to reap the full revenue potential of RCS, initial marketing campaigns over the channel must start simple before introducing complex RCS campaigns that include features such as item carousels and personalised content. Since RCS can offer much richer features compared SMS, as enterprises and consumers are accustomed to using SMS, introducing these richer features at a gradual rate is anticipated to generate more engagement, and thus improving campaign success.

Despite the growth of RCS being off to a slow start, will 2024 be the year where enterprises finally adopt RCS as a business messaging channel?

As a Senior Research Analyst within Juniper Research’s Telco & Connectivity team, Elisha analyses the latest developments in markets such as Business Messaging, CCaaS, and Wholesale Roaming, and SMS Firewalls. She has also been interviewed by major news outlets such as CNBC and Forbes, and has spoken at high-profile industry events, including Mobile World Congress and MEF CONNECTS Business Messaging.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW

-

Fintech & Payments

Fraudulent eCommerce Transactions to Surpass $131 Billion by 2030 Globally; Driven by Escalating Friendly Fraud

February 2026 -

Fintech & Payments

Mobile Money Users in Emerging Markets to Reach 2.2 Billion by 2030, as Interoperability and Integration Drive Growth

February 2026 -

Telecoms & Connectivity

Juniper Research Unveils 2026’s Telecoms & Connectivity Award Winners

January 2026 -

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026