Stripe Expands Pay by Bank to France & Germany – But Can It Dethrone the Card?

Stripe, a global provider of payments software to businesses, has expanded its offering of account-to-account (A2A) payments to Germany and France through a continued partnership with TrueLayer, an Open Banking platform.

Stripe’s A2A product, called Pay by Bank, uses TrueLayer’s Open Banking infrastructure which connects bank accounts across Europe; enabling merchants to accept transactions directly from a customer’s bank account. This expansion follows the success of Stripe and TrueLayer partnering to offer the same service in the UK in September 2024. There is reason for Stripe to be optimistic about this expansion, with TrueLayer already processing €2 billion ($2.4 billion) of Pay by Bank transactions in France and €1.4 billion ($1.6 billion) in Germany.

Advantages of Pay by Bank

There are several advantages for merchants accepting payments by Pay by Bank over traditional payment methods.

One of the primary advantages is the lower transaction fees, especially when compared to card networks. The cost of card transaction fees is significant to businesses, as it is the most common form of consumer payments in the markets in which Stripe has so far launched Pay by Bank.

Another important advantage for merchants is the lack of chargebacks on Pay by Bank.

Chargebacks, both legitimate and fraudulent, represent a significant cost for many merchants. The large increase in fraudulent chargebacks in recent years has only increased the burden. Even when a fraudulent claim is beaten by a merchant, it takes time. This is a time when the merchant does not have access to the payments; interrupting cashflow which can push businesses to rely on financing, further increasing costs. Chargebacks also require a merchant to allocate resources to fight the chargeback, whether that is staff spending time putting together evidence, or the merchant spending money on a chargeback management platform to undertake this task.

Another benefit of Pay by Bank is its increased security. In the markets Stripe is targeting, there are clear Open Banking regulations, as well as the requirement for strong customer authentication from the Second Payment Services Directive (PSD2). These, together with the fact banks employ their own strong anti-fraud systems, mean that Pay by Bank is relatively resistant to fraud.

These advantages are more attractive to small and medium-sized enterprises (SMEs), as these costs represent a larger proportion of costs for merchants of this size, compared to large enterprises and multinationals who are more able to absorb the additional costs. As Stripe’s primary customer base are SMEs, this makes Pay by Bank a particularly valuable addition to its payments acceptance offering.

Another advantage for merchants is customer satisfaction, given the convenience that Pay by Bank provides. To pay using Pay by Bank online, the consumer simply has to select the Pay by Bank option at checkout and then verify their identity. This is quicker than manually entering payment card details and can be more secure as it can be verified using biometric verification. Likewise, refunded monies can be back in the customer’s bank account within seconds, minimising a too-often significant cause of frustration for consumers.

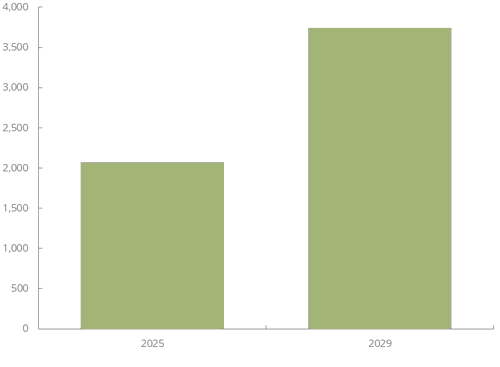

Juniper Research expects that these advantages will drive an 80% growth in the number of online A2A payments users between 2025 and 2029.

Total Global Online A2A Payment Users (m), 2025 vs. 2029

Source: Juniper Research

Challenges of Pay by Bank

Despite these advantages, Pay by Bank is not without its challenges.

The most significant challenge is consumer attitude. Many consumers are simply not aware of Pay by Bank as a payments option. Those who are aware of it may not fully understand what exactly it is or understand the advantages it offers over traditional payment methods. This compounds with consumers’ existing preference for card payments. Consumers are familiar with cards and trust them to be secure. There is also consumer protection in place, in markets such as the UK; ensuring that consumers get their money back if they are a victim of fraud that was not their fault. This makes any security advantages of Pay by Bank less of a concern for consumers.

Another disadvantage of Pay by Bank, compared to credit cards, is its inability to extend lines of credit or offer rewards for its use. This means those who use credit cards are very unlikely to give up these benefits for the additional convenience of using Pay by Bank.

A limitation of the payment method is its reliance on Open Banking regulation to enable it, without needing to partner with the consumer’s bank. Without Open Banking, the process of enabling Pay by Bank is significantly complicated, and banks’ unwillingness to partner to allow this can significantly restrict coverage. This means Pay by Bank is unlikely to gain much traction in any market that does not have Open Banking regulations to support this payment method.

Another challenge is facilitating cross-border transactions using Pay by Bank. Due to Pay by Bank’s reliance on regulations facilitating the payment method, there are markets, such as the US, where merchants are less likely to accept it. Equally, for merchants that have many international customers, a proportion of these customers will not have Pay by Bank supported in their country. This contrasts with the major card networks, where merchants will have customers in nearly every market and facilitate cross-border transactions between them regularly. This is not an issue within the EU, as all countries have the same Open Banking regulation, as do other countries which have signed up for regulatory alignment.

Pay by Bank is gaining traction in markets where the regulatory framework is in place. Partnerships, such as the one between Stripe and TrueLayer, will further boost this payment method, with it becoming easier for merchants to accept these payments. Juniper Research expects that Pay by Bank will continue to grow over the coming years, especially if Pay by Bank providers focus on raising awareness among consumers. However, it will be quite some time before it becomes a true competitor to the major card networks.

As a Senior Research Analyst, Michael delivers in-depth insights into the fast-evolving worlds of digital identity and payments. His recent work spans critical topics such as Digital Wallets, Digital Identity, and Instant Payments; helping industry leaders navigate change and identify new opportunities.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026