Navigating the Smart Traffic Boom: 5 Ways Vendors Can Drive ROI & Adoption

Last week was an exemplary week for the smart traffic management market, with the UK government announcing a transport AI action plan that aims to deliver smarter, safer and greener journeys. The 23-point action plan aims to integrate AI across the UK’s transport systems, to optimise traffic flows, infrastructure management and public transport systems, as well as accelerate decarbonisation goals in the transportation sector.

In addition to this, Milestone Systems, a video technology software company announced that its Project Hafnia would be coming to Europe, beginning with the city of Genova. The project aims to provide developers with high-quality video data to accurately train visual AI models. Project Hafnia is in partnership with NVIDIA, and leverages NVIDIA’s NeMo Curator platform which is designed to enhance AI training. In Italy, the project will be used to enhance traffic management systems using video data trained on the NVIDIA platform.

These two projects highlight the acceleration of smart traffic adoption, which has previously been slowed by budget constraints, especially when transportation departments and agencies have to upgrade or update legacy systems.

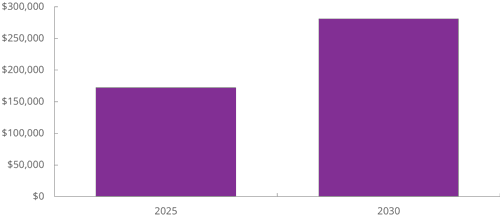

A key driver of the accelerated adoption of smart traffic management solutions is the cost saving that can result from reducing emissions and congestion; which our latest research anticipates will reach $281 billion by 2030.

Total Congestion & Emissions Cost Savings by Smart Traffic Management Systems ($m)

Source: Juniper Research

Driven by the substantial cost savings smart traffic management systems can deliver, Juniper Research predicts the market will surge to $32.7 billion by 2030; a 121% increase from $14.8 billion in 2025.

To take full advantage of this rapid growth over the next five years, smart traffic management providers should focus on the following strategic priorities:

Strategy #1: Development of Hybrid Solutions

With the proliferation of cloud computing, Juniper Research expects hybrid deployments, which combine on-premises deployments with a cloud and edge computing element, to be the most popular deployment model.

This deployment model strikes a balance between the flexibility, scalability and real-time response of cloud and edge computing, and the security and control of on-premises deployments. In addition, it allows vendors to ensure predictable recurring income through the use of subscription-based business models for services such as device equipment maintenance or traffic analytics; thereby maximising revenue.

Strategy #2: Highlight Return on Investment (ROI)

Given that budget constraints have previously slowed growth in the market, smart traffic management vendors must ensure they collect data on how effective their products and solutions are at providing a fast ROI, as well as for reducing carbon emissions. As the market becomes more competitive this will become a key marketing tool for vendors.

In addition, smart traffic management vendors must offer flexible payment services, as this will be a key factor in transportation departments choosing them over other competitors. Vendors can do this by offering monthly repayments to spread the purchase cost, or by adopting modular solutions which allow clients to upgrade over time. This will lower the barrier to entry, enabling more transportation departments to adopt smart traffic management solutions.

Strategy #3: Data Monetisation

In the era of Big Data, smart traffic management vendors have a unique opportunity to tap into a new revenue stream: data monetisation. The data they collect on traffic flows is useful to a number of industries, including insurance, marketing, tourism, retail and telecommunications.

To take full advantage of this opportunity, vendors must ensure that they offer access to both raw data and key analytic insights on a tiered subscription model, with raw data being offered in lower tiers and the premium tiers including access to more insights and analytics. Vendors must ensure they have the right permissions to monetise data before they offer these services; ensuring the use of data with customers in their contracts.

Strategy 4: Adopt an Interoperability-first Approach

As legacy systems are still widely used, smart traffic management vendors must ensure they create solutions that are highly interoperable. They can do this by developing and supporting open APIs and plug-and-play solutions.

Vendors should also incorporate middleware into their solutions, to enable clients with legacy software to enhance their systems without completely replacing them. To do this, smart traffic management vendors must ensure they adopt a modular system architecture, enabling clients to enhance their systems without overhauling them.

Strategy 5: Implement Robust Data Privacy

Data privacy remains a key concern in gaining public acceptance of smart traffic management solutions. Smart traffic management vendors must tackle this issue by using privacy-enhancing technology (PETs), which are methods of minimising personal data collection. These methods range from using AI to generate synthetic datasets that mimic real datasets, to using data anonymisation techniques that remove personal data.

In addition to implementing enhanced data privacy techniques, smart traffic management vendors must also adopt a secure-by-design approach to developing their traffic monitoring products, as well as incorporating robust security into their products. Juniper Research anticipates that cyber security threats will continue to increase, and thus adopting these solutions will be key to ensuring data privacy and integrity, as well as gaining public acceptance and trust.

Michelle is a Research Analyst in Juniper Research’s IoT & Emerging Technology team, where she explores some of the most dynamic and fast-moving areas of tech. She delivers insight and analysis on rapidly evolving markets, such as Smart Traffic Management, Private Cellular Networks, and Quantum Technology.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026