Is There Room for Local Card Schemes in a Visa-Mastercard World?

The card payments space has been a challenging place to be for many years, as the duopoly of Visa and Mastercard has long since taken a dominant role. While local card schemes have existed for a long time, they have typically not fared well against the leading international schemes. Even card networks such as Discover and American Express have struggled to grow their acceptance to similar levels as Visa and Mastercard; showing the scale of the challenge.

However, domestic card networks are fighting back, with two new announcements in recent days: a new pan-African card scheme, and a strategic realignment of Dankort.

Pan-African Card Scheme Launches to Harmonise Payments

Unveiled at the 32nd Afreximbank Annual Meetings in Abuja, Nigeria, the PAPSSCARD is designed to be the first Africa-wide card scheme. A joint venture between the African Export-Import Bank, the Pan-African Payment and Settlement System (PAPSS) and Mercury Payment Services, PAPSSCARD is designed to help Africa secure its payments sovereignty.

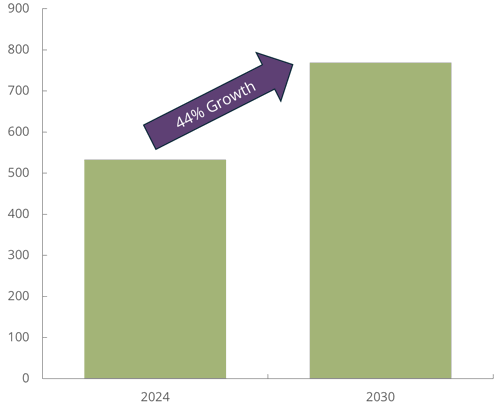

The launch of this service will enable card processing to stay within Africa; creating local economic benefits. The timing and roll-out plans of the new system is unclear, but the system could have a significant impact on the African payments market, particularly as the next few years are set to see a significant increase in banked population, with growth of 44% in the number of banked individuals expected between 2024 and 2030.

Number of Banked Individuals in Africa & Middle East (m), 2024-2030

Source: Juniper Research

Big Changes for Dankort as Landscape Shifts

Denmark has historically been a very popular market in terms of domestic card payments. Dankort was first issued as a national debit card in 1983, and has had a very important role as a key payment system in use within Denmark. However, its popularity within the payments ecosystem has been slipping, with the Ministry of Business & Industry sharing that while Dankort accounted for nearly 80% of card transactions nine years ago, now it is far closer to 40%.

This diminished importance is heavily related to the shift towards mobile payments which has been seen in many countries, particularly in Denmark. Where Dankort cards are typically co-branded with Visa or Mastercard, mobile wallets have relied on the international aspects of those cards; diminishing the importance of Dankort’s network over time. Payment system operator Nets has already begun to change this, by working with card issuers to ensure that the Dankort portion of these cards can be used within mobile wallets.

The Danish government’s new deal for Dankort will make several changes:

- Raising the limit on fees so Nets can charge more; funding technological upgrades

- Adding a balance check feature

- Targeting businesses and associations which struggle with high costs of existing payment options

Fundamentally, we believe that the move will make Dankort more competitive; increasing its presence within the digital portion of the market at a time where this progress is sorely needed. However, given that Dankort’s market share has already significantly dropped, reversing this trend will be challenging to achieve.

Domestic Card Schemes – Backing the Wrong Horse?

There is an extent to which it is surprising that domestic card schemes are a focus on efforts at this stage. Mobile payments have transformed the way payments markets operate across the world, so when trying to gain sovereignty over payments, mobile payments, such as Account-to-Account (A2A) payment schemes, have strong potential. A2A payments have been highly popular, and are seeing massive growth, with our latest research on the topic projecting that the number of A2A transactions for consumers expected to growth by 209% globally between 2024 and 2029, based on our data.

Indeed, the European Payments Initiative has chosen to focus on Wero, a mobile wallet solution, rather than a pan-European card scheme as was originally suggested. A2A payments can also been cost-effective to implement, as they do not require the same fixed infrastructure as card payments do. Visa, Mastercard and many of the other card schemes also do a good job of serving customer needs, so competing effectively with them is not an easy task.

Fundamentally, there is no one size fits all approach in payments. In certain countries, new A2A schemes or domestic card schemes will succeed massively, and in others they will fall flat. Choosing the right solution, based on cultural factors and country-level requirements, will be the key to success. In future, we expect more domestic card schemes to be introduced, but their success will be uncertain in a highly competitive payments landscape.

Nick Maynard is VP of Fintech Market Research at Juniper Research, where he leads analysis on key trends shaping the future of finance. With deep expertise across digital payments and commerce, his recent work includes reports on Chargeback Management, Digital Commerce, and Payment Card Technologies; helping stakeholders stay ahead in a rapidly evolving market.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026