Is It Time for Digital Travel Credentials to Take Off?

International travel is a massive industry; over 800 million people travelled internationally in 2023, according to Juniper Research data. Over half (53.2%) travel by air, with land travel being the second most common mode (43%). The number of travellers will continue to grow, driven by the growth of international tourism and business trips in high-growth developing markets, especially China.

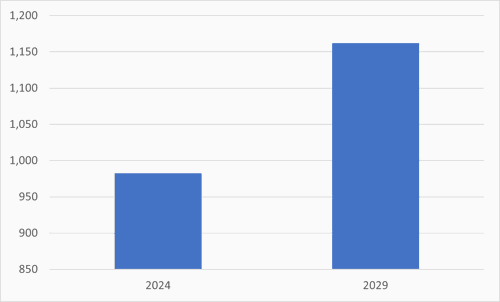

Global Number of People Travelling Internationally (m), 2024 vs. 2029

Source: Juniper Research

As in all other industries, international travellers are increasingly demanding a more streamlined and digital service. Air travel in particular is notorious for its slow check-in process, although identity checks at any border can be time-consuming. It is this friction that is driving the move towards DTCs (Digital Travel Credentials).

There are three categories of DTCs:

- Type 1: Type 1 DTCs are eMRTDs (Machine Readable Travel Documents) that are generated by reading the physical travel credential’s chip, with either a smartphone or a self-service kiosk. For Type 1 DTCs, the user must still carry the physical document, with the eMRTD acting as a form of authentication.

- Type 2: Type 2 DTCs are issued by the same authority as a physical passport, signed by the authority, and linked to the physical passport. The DTC is linked to physical devices and can be used independently of the physical document, which acts as a backup to the DTC. It is important to note that the DTC is based on a physical document, which must still be issued first.

- Type 3: Type 3 DTCs are issued and signed by the issuing authority, and stored on devices. The DTC is not linked to a physical component, which means it can be issued to an individual who does not have a physical passport.

These three different varieties of DTCs offer a progression of how DTCs can be introduced, with the need for physical travel credentials phased out over the three types. This is important, as many governments do not want to abandon physical passports at this point in time. This can be largely attributed to security concerns, with the established system being trusted by authorities. In many markets, a section of the population is either opposed to the principle to digital identity documents of any kind, or not technologically proficient. It is important that governments maintain services to these groups, necessitating the maintenance of physical passport services.

As things stand, no country has fully implemented DTCs, although several pilot schemes have been carried out. This includes a trial which ran between August 2023 and March 2024 in Finland, and another carried out from the 29th February to the 31st of March 2024 in the Netherlands. These pilots were considered successful, with the Finnish pilot carrying out 355 successful DTC checks, with the average check taking eight seconds. The pilots, which both used Type 1 DTCs, were used to inform the EU’s regulation of border checks with DTCs.

The positive results of these pilots indicates that the EU will be introducing regulation to allow the implementation of Type 1 DTCs. These will be combined with automated facial recognition technology, to allow DTC users to progress more quickly through airport check-in. These DTCs will be focused on air travel, as passports are not needed to travel through the Schengen Area, and international travel across sea borders is rarer and generally poses less friction.

In the future, DTCs within the EU will be able to be held within a European Identity Wallet, as set out in the eIDAS2 regulation; this will be the ideal place to store a Type 2 or Type 3 DTC. Based on this knowledge, Juniper Research expects the EU to lead the way in the adoption of DTCs over the medium term.

Outside of the EU, there is less concrete movement towards Type 1 DTCs. However, the ICAO (International Civil Aviation Organisation) has been active in promoting standards, defining the categories of Type 1, 2 and 3 DTCs. This work will make it easier for countries to adopt DTCs, as the credentials will operate on the same standards at both ends of the journey. Countries looking to implement DTCs must ensure that they offer a smoother customer experience than the current system provides, to ensure consumer adoption.

Michael is a Senior Research Analyst at Juniper Research, and primarily conducts research on digital identity and payments markets. His recent reports include Digital Identity, Instant Payments, and B2B Payments.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026