Is 2025 the Year of Digital ID in the UK?

The UK is a market often noted for its resistance to digital ID or national identity systems in general. It is often believed that the UK public are less open to the idea than citizens of other countries and prioritise privacy over the efficiency gains a digital ID system could offer. However, this is slowly changing, as indicated by a YouGov poll in December 2024 which found strong support for a system of national identity cards in the UK.

Question: Would you support or oppose the introduction of a

system of national identity cards in Britain?

Source: YouGov

Another significant movement in December 2024 occurred with the unveiling of new proposed legislation that, if passed, would enable UK residents to use digital IDs to verify their age when buying alcohol. This will be applicable in pubs, clubs, and shops. The IDs will be provided by third-party companies and checked against government records, with these checks carried out by either NFC or QR codes, ensuring the process is streamlined. These digital IDs will also not reveal the user’s name or address, as is the case with traditional IDs.

These changes will come from the Data (Use and Access) Bill, introduced to Parliament in 2024. The bill is currently in the House of Lords, with it still needing to pass the House of Commons and gain Royal Assent before it becomes law. In its press release, the Department for Science, Innovation and Technology state they expect it to be in force by the end of 2025.

This follows on from the 2023 decision, by the previous government, to allow UK citizens to upload identity documents to apps in order to carry out Disclosure and Barring Service (DBS), right to work, and right to rent checks. These services are provided by third-party identity services, such as Yoti, and it is expected that the same companies will be involved in the provision of the new digital IDs.

Source: Yoti

It is worth stressing that this will be a fairly limited programme, with participation entirely optional for both consumers and businesses. This will likely result in slow and uneven adoption, as was seen with the 2023 roll-out of digital IDs, with the vast majority of locations which accepted these IDs being in London or other major cities. This is due to the fact that consumers are unlikely to adopt the technology unless it is usable in a good number of the locations they use. Equally, businesses are less likely to adopt it if consumers are not using it. This results in the market for these technologies taking longer to reach critical mass and become widespread.

It is not only in the consumer sector that digital identity is growing in the UK. In December 2024, a coalition of leading financial institutions and technology companies, led by the UK’s Centre for Finance and Innovation Technology (CFIT), unveiled their progress on designing a digital company ID.

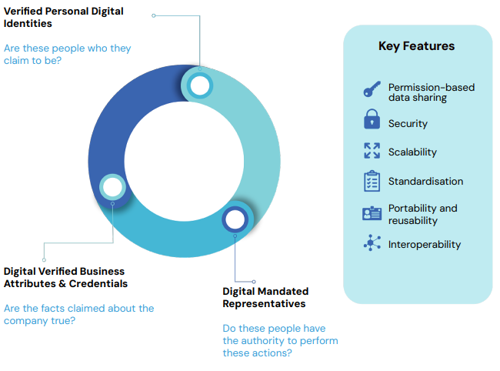

Proposed Components of 'Digital Company ID'

Source: CFIT

The proposed model would enable CFIT to create a working prototype, in the form of a virtual passport for businesses. CFIT suggest that the widespread adoption of a digital company ID would help prevent fraud, boost efficiencies for banks and other financial institutions. This work was supported by the Chancellor, in the National Payments Vision published in November 2024, with the document pledging to ‘consider any finding that emerge from CFIT’s work in due course’. CFIT will announce the results, recommendations and next steps from its programme in March 2025.

The adoption of digital IDs for businesses would reduce fraud as it is more challenging to fake a digital identity. This would give businesses the confidence that those they transfer money to are who they claim to be. The IDs would also be used for Know Your Business (KYB) checks, along with ultimate beneficial owners (UBO) checks and comparison to anti-money laundering (AML) databases. If implemented well, this technology could not just reduce financial crime but also allow businesses to save costs on carrying out these checks by conventional methods. Adoption in the financial sector is likely to be strong if made available, as several major FIs are already involved in the project. Regulatory support is also likely as the Financial Conduct Authority (FCA) and the Payment Systems Regulator (PSR) are both involved.

With both these announcements coming at the end of 2024, 2025 is shaping up to be a big year for digital identity in the UK. While it seems unlikely there will be widespread adoption of a digital ID in the UK by consumers before the end of 2025, the foundations for such a success story are being laid. If the Government wants this to happen, targeting key use cases will be essential. Common points of friction for consumers, such as age verification at self-service checkouts, or entry to licensed premises, will play an important role in promoting adoption. It is usual for consumers to have their mobile device on them in such circumstances, so as such, having their ID on that device offers great convenience. It will be the convenience of use and acceptance rate by businesses which ultimately will determine the success of the technology.

A Senior Research Analyst at Juniper Research, Michael primarily conducts research on digital identity and payments markets. His recent reports include Digital Identity, Instant Payments, and Digital Wallets.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW

-

Fintech & Payments

Fraudulent eCommerce Transactions to Surpass $131 Billion by 2030 Globally; Driven by Escalating Friendly Fraud

February 2026 -

Fintech & Payments

Mobile Money Users in Emerging Markets to Reach 2.2 Billion by 2030, as Interoperability and Integration Drive Growth

February 2026 -

Telecoms & Connectivity

Juniper Research Unveils 2026’s Telecoms & Connectivity Award Winners

January 2026 -

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026