Digital Identity Cards in the UK – Controversial, But Will They Work?

The UK Government has announced that it intends to introduce digital identity cards, held on people’s phones. The proposed 'Brit Card' would be a digital form of identification held in a UK government app and would be mandatory for certain uses, such as proving one’s right to work in the country.

Prime Minister Kier Starmer described the plans as follows: “Digital ID is an enormous opportunity for the UK. It will make it tougher to work illegally in this country, making our borders more secure. And it will also offer ordinary citizens countless benefits, like being able to prove your identity to access key services swiftly – rather than hunting around for an old utility bill.”

These plans will see the Brit Card become available to all UK citizens and legal residents in the UK by the end of the current Parliament, currently scheduled for August 2029, though the plans will require legislation and a public consultation.

Identity Cards in the UK – A Troubled Past, But Promising Future?

Any mention of the issuing of identity cards is a contentious one in the UK, with former Prime Minister Tony Blair’s government in the early 2000s proposing, under the Identity Cards Act 2006, and subsequently failing to roll-out a national identity card scheme.

While identity cards are mandatory, or at least offered, in a large number of countries, they have been controversial in the UK due to civil liberties concerns. The focus on using digital identity as a method to curb illegal working in the UK economy represents a different strategy from before, but it is still a highly debatable move.

However, if the political challenges can be navigated, there is high potential for such an approach. By providing cards free of charge and providing the ability to check right to work versus a government database, this would make right to work checks quicker and easier, and could potentially simplify enforcement. Outside of the immigration argument, there are numerous benefits to digital identity use – easier access to government services, the ability to seamlessly age verify during online and in-person transactions, and many others. The potential is there, but the path to making a success of digital identity in the UK will be challenging.

Initiative Must Learn the Lessons of Other Countries and the Past

In order to make a success of digital identity in the UK, the UK Government must learn from both technology failures in the UK as well as best practice from other markets. Learning from key examples, such as Norway’s BankID, Singapore’s SingPass, and India’s Aadhaar, is vital to success. A few key considerations are the following:

- Benefits must be clear - The benefits of the scheme, rather than the requirement to have a digital ID for legal reasons, should be communicated clearly, such as easy access to government services.

- Third-party support and interoperability are vital - The UK has a vibrant digital identity market, particularly in the verification space, so ensuring the market is included is important. Also, interoperability with existing identity elements, verification types, and international schemes would be desirable.

- Accessibility matters - While a large majority of users have the means to access online services, ensuring that vulnerable users - such as the elderly, disabled or the homeless - can still access systems is vitally important. Excluding users from accessing services they are entitled to, due to a lack of a smartphone or Internet access, would be extremely damaging.

- Consider fraud - When any digital service launches, considering the potential for fraud is vital. Ensuring that identities are verified when entering the system will be important to ensuring the stability of the system.

When considering other initiatives in flight, the EU’s eIDAS 2.0 initiative, which is creating a broad EU ID wallet system for roll-out in 2026, is an important scheme to consider. From a collaborative point of view, with the EU as the UK’s biggest neighbour, interoperability between systems would be desirable.

Taking the design of the EU system to heart is important too. eIDAS 2.0 places the citizen in control of their data: what is shared to whom and when, and so building the Brit Card with this citizen-permissioned philosophy will go a long way to securing buy-in for the scheme.

The UK Government should also consider the history of IT project overspends and failures in the UK public sector, such as the hugely costly National Programme for IT in the NHS, which was estimated to have cost £10 billion ($13.4 billion) when it was shelved in 2011. Ensuring that this kind of failure does not reoccur is important. The UK Government should ensure that its approach to digital identity remains focused and consistent, with a previous private-led approach to digital identity being disrupted by a public-led model.

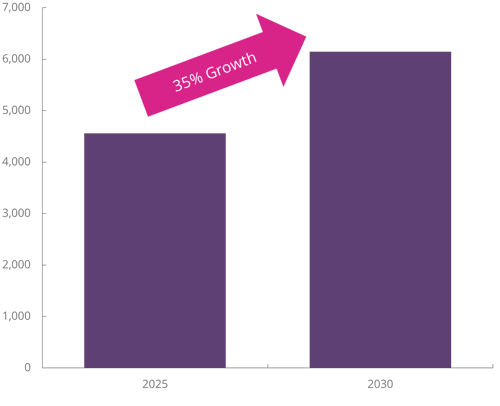

Despite the many challenges involved, digital identity cards, overall, have strong potential. For this reason, our latest research points to a 35% growth in the number of people with digital identity cards between 2025 and 2030.

Number of People Globally With Digital Identity Cards (m) 2025 vs. 2030

Source: Juniper Research

Future Outlook

Clearly, the use of identity cards of any type in the UK will always be divisive, and whether the scheme actually comes into service is a matter for debate. However, despite the difficult challenges to navigate, there is strong potential for digital identity use.

Digital identity can empower citizens, provide them with streamlined access to services, and give them control over how their identity is used. As the UK Government moves forward with Brit Card, it must make a positive argument for how the scheme will empower citizens, and how civil liberties will be enshrined. If it fails to articulate a positive case with robust controls, adoption and usage of the system - if implemented - will struggle to gain traction.

Nick Maynard is VP of Fintech Market Research at Juniper Research, where he leads analysis on key trends shaping the future of finance. With deep expertise across digital payments and commerce, his recent work includes reports on Chargeback Management, Digital Commerce, and Payment Card Technologies; helping stakeholders stay ahead in a rapidly evolving market.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026