Capital One Finalises Discover Acquisition: What Does it Mean for Payments?

On Sunday May 18th 2025, Capital One announced that it had finalised the acquisition of Discover Financial Services; completing a drawn-out process which started in February 2024.

This deal, which faced intense regulatory scrutiny, brings together Capital One’s large credit card and financial services business with Discover’s credit card business, Diners Club International brand, PULSE Network, and Discover’s card network; creating the largest credit card issuer, in terms of volume, in the US market. The acquisition came to a total value of $35 billion; representing a massive deal within the payments market in the US.

So, now this massive deal has completed, this blog will explore what the outcome will be – the impact will this have on the wider payments space, and are we going to see fundamental change?

Deal Shakes Up US Credit Card Market

The US credit card market is a highly competitive one, with numerous different players. JPMorgan Chase and American Express have typically been prominent players, but Capital One has also had a strong presence in the market. The US market is a strong mix of high street banks, credit card specialists, digital-only banks, and credit unions, who are all increasingly offering credit cards. Credit cards are high value to banks in terms of revenue, and they allow banks to generate primacy (where they are the main account a customer uses); of high importance in an increasingly congested banking market.

Therefore, in this context, Capital One reinforcing its credit card efforts is a clear strategic move, and will enable it to access a wider part of the market. While the brands are confirmed to be independent to start with, there will likely be consolidation over time; which would create benefits for customers.

Another interesting aspect of this deal is the B2B payments market.

B2B payments is a massive market, with the value of payments globally set to reach $124 billion by 2028, according to our latest data. By expanding its credit card offering, Capital One can move to access this commercial payments area to a much greater degree. Historically, Discover has been focused on the commercial payments space, so this will enable Capital One to leverage Discover’s capabilities to bolster its appeal.

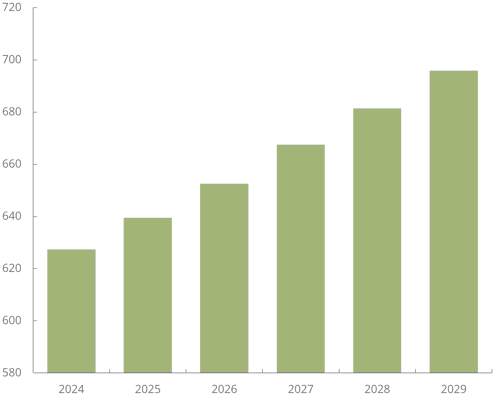

With almost 700 million credit cards being issued globally in 2029, the credit card market is wide beyond the US. By leveraging Discover’s Diners Club brand, which has a strong international component, Capital One will be able to consolidate its international credit cards presence; growing its revenue overall.

All in all, the credit card market will receive a major shake-up, with competition further intensifying.

Credit Cards Issued Globally (m), 2024-2029

Source: Juniper Research

Can Capital One Make Discover a Viable Visa and Mastercard Alternative?

Arguably, the network aspect of Capital One’s purchase of Discover is the most exciting.

Discover offers the Discover Network, PULSE, and Diners Club International, all of which add value to Capital One. PULSE offers strong debit capabilities, across debit cards, ATMs and acceptance. Diners Club is an international credit card brand accepted in over 200 countries and territories. The most interesting element is Discover’s global network. This network operates across the globe and has rising acceptance, supported by an extensive range of partnerships with domestic card schemes such as RuPay (India), mada (Saudi Arabia), and Elo (Brazil).

As such, this network capability gives Capital One a tool it has not had before – its own network on which it can conduct its own transactions, rather than relying on Visa and Mastercard. Indeed, it gives Capital One the opportunity to scale a network to compete with these major players; potentially weakening the duopoly we have seen in the international card network market.

How likely is this to happen? Fundamentally, Discover has struggled to bring its acceptance levels close to Visa and Mastercard’s, so it is still quite a way behind. However, Capital One’s reach and size within the market should give Discover more power to influence merchants into supporting its network. It remains to be seen how extensive Discover’s acceptance will become in the Capital One era, but it is likely to see a boost. We also expect that Capital One will steadily transfer its cards to leverage the Discover network; lowering its costs significantly and giving it more control over its offerings. While this will boost its credit card offering, it will take longer for Discover’s network to close the acceptance gap and break the duopoly.

Is The Era of the Mega Deal Back?

For the past couple of years, fintech and payments have seen readjustments in terms of funding and deals; with many startups seeing reduced valuations in funding rounds in recent times. However, the size of this deal ($35 billion) potentially shows that we are returning to the era of massive deals in the market. Indeed, this has been followed by Global Payments announcing in April 2025 that it was acquiring Worldpay for $24.2 billion; another mega deal.

Fundamentally, competition is rife in payments, and consolidation is a strong force in the market. As market leaders look to better cope with competition from alternative payment methods and new market entrants, consolidation of larger brands is expected to intensify, fuelling future deals.

All in all, Capital One’s deal to acquire Discover is a major one, beyond the large price tag, on the basis that it shakes up the well-established credit cards market; and threatens to compete with Mastercard and Visa.

Over time, we expect Capital One to use its market presence to grow Discover’s network as well as its own credit products; creating a major force within the US payments market. As alternative payments become more important in the US market, we expect greater consolidation. However, as with any merger and acquisition, integration is the biggest challenge. Capital One must work hard to derive value and unlock alignment, in order to take its next step in the market.

Nick Maynard is VP of Fintech Market Research at Juniper Research, enabling clients to size new market opportunities, set priorities for future growth, and understand their customers through survey projects. He also enjoys helping clients promote their expertise and vision of markets with compelling thought‑leadership whitepapers, webinars, and other media.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026