Building a Successful Superapp: Lessons from Careem

Superapps have been a major point of discussion in the fintech space for several years, with many payment apps and digital wallets having ambitions to become one. The primary motivation for becoming a superapp is the expansion of revenue streams, which can increase an app’s profitability and diversify its sources of revenue, protecting the business from a downturn in any one area.

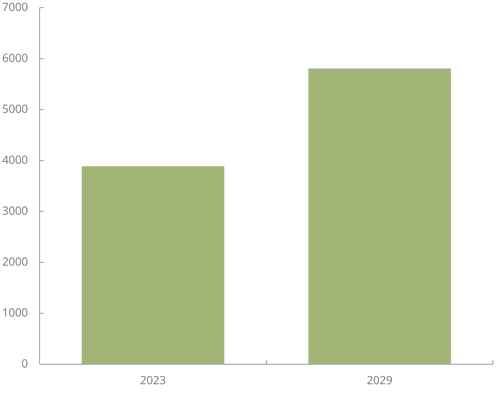

Given this advantage, it is easy to understand why a digital wallet would want to become a fully fledged super app. There is clearly growing potential for this, with our latest forecasts showing that the number of people using digital wallets will grow by 46% between 2024 and 2029.

Number of People Using Digital Wallets (m), 2024 and 2029

Source: Juniper Research

For businesses looking to adopt the superapp model, it is important to understand how other successful superapps have gained their position in their respective markets.

Let's look at Careem.

Careem was founded in 2012 in the UAE as a ride-hailing app. Since its launch, it has expanded its geographic coverage, and is now available in cities in Qatar, Saudi Arabia, Egypt, Morocco, Pakistan, Jordan, Iraq, Bahrain, and Kuwait. It has also expanded into groceries, deliveries, and payments. By 2024, Careem had more than 48 million customers across 80 cities in the 10 countries in which it operates.

Almost all superapps start off as specialised apps; in Careem’s case this was as a ride-hailing app. The advantage of starting off in this way is that it requires less development to get a working app ready to deploy compared with a more broadly focused one; allowing for lower costs and faster time to market. Another strength of this method is that it allows the app to target a specific gap in the market to build up a user base.

Source: Careem

It is important that, if a brand is launching a specialised app, with the intention of it becoming a superapp, the app is designed with modularity in mind. This will make it easier to integrate new features into the app as it grows. One effective way to go about this would be to build the app using a third-party platform. This is cheaper than hiring a development team to build it, and it allows the new app to benefit from the experience of the platform provider. It is crucial that a business selects the right platform for their app as, once one is selected, the vendor is limited by the platform’s capabilities. This means that selecting the wrong platform can prevent a vendor from expanding its capabilities into new areas as opportunities present themselves.

Once an app is established, the next step is to grow it. This is in terms of user base, geographic coverage, and range of services offered. In Careem’s case, it took the approach of focusing on expanding geographically. Between 2012 and 2017, it expanded to cover the 10 countries it covers today, but the only added features were ones which strengthened its ride-sharing business. This strategy grows the user base, building trust and familiarity with users. Due to this, as services expand, existing customers are more likely to adopt a new service from a provider with which they are already familiar.

A payment feature is a consistent part of most superapps. This allows the app to facilitate payments for its own services internally, as well as to tap into revenue from different types of money transfers. Careem first entered into the digital payment space with Careem Pay, a closed-loop P2P money transfer system. This was expanded into a full open-loop payment wallet in 2020, which allowed it to make payments and withdraw funds from the ecosystem. In 2023, Careem added remittances, starting off with the UAE-Pakistan corridor. This was to take advantage of the fact many of its drivers were Pakistani citizens who already transferred their income back to Pakistan. This was sufficiently successful that it has since expanded to include remittance corridors to the UK, India, and the Philippines.

This shows two important trends to making a successful superapp: understanding users and integrating suitable new services with existing ones. Careem understood that many its users were migrant workers who would be sending money to their home country. As these workers were earning money as drivers on the Careem app, this meant it already stored the money the user wished to transfer. This combined the ride-hailing element of the app with the remittance feature; creating an overall stronger offering. When adding new features, particularly payment ones, a brand must look at who its customer base is and what services it already offers. By offering services that synergise with existing offerings, and targeting existing customers, an app can maximise the chances of a new feature’s success. The downside to this is it focuses on an existing user base; potentially limiting its ability to grow the total customer base.

Source: infinum

Careem sets a clear example of how to grow a specialised app into a superapp, with others such as Grab and Gojek following similar paths. Vendors looking to launch an app or expand an existing one must understand what these success stories did to get to where they are, and draw relevant lessons for themselves. Key considerations are modularity from the beginning to simplify the process of expanding the wallet as it grows, targeting features to a specific audience or a gap in the market, and using inbuilt payments and funds to provide a seamless checkout experience and keep a user’s money within the superapp ecosystem.

Michael is a Senior Research Analyst at Juniper Research, and primarily conducts research on digital identity and payments markets. His recent reports include Digital Wallets, Digital Identity, and Instant Payments.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Fintech & Payments

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging Technology

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & Connectivity

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW -

ReportDecember 2025

ReportDecember 2025AI Agents for Customer Experience Platforms Market: 2025-2030

Our comprehensive AI Agents for Customer Experience Platforms research suite comprises detailed assessment of a market that is set to disrupt mobile communications. It provides stakeholders with insight into the key opportunities within the AI agents for customer experience platforms market over the next two years.

VIEW -

ReportDecember 2025Fintech & Payments

ReportDecember 2025Fintech & PaymentseCommerce Fraud Prevention Market: 2025-2030

Our eCommerce Fraud Prevention research suite provides a detailed and insightful analysis of this evolving market; enabling stakeholders from financial institutions, law enforcement agencies, regulatory bodies and technology vendors to understand future growth, key trends, and the competitive environment.

VIEW -

ReportNovember 2025Telecoms & Connectivity

ReportNovember 2025Telecoms & ConnectivityeSIMs & iSIMs Market: 2025-2030

Juniper Research’s eSIMs and iSIMs research suite offers insightful analysis of a market set to experience significant growth in the next five years. The research suite provides mobile network operators (MNOs), original equipment manufacturers (OEMs), and eSIM management and platforms vendors with intelligence on how to capitalise on the market growth, and guidance on how eSIM-only devices and sensors, SGP.42, in-factory provisioning, and iSIMs will change the competitive landscape.

VIEW

-

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW -

WhitepaperJanuary 2026Telecoms & Connectivity

WhitepaperJanuary 2026Telecoms & ConnectivityHow Fintechs and Retail Companies Are Changing Mobile Services

Our complimentary whitepaper, How Fintechs and Retail Companies Are Changing Mobile Services, explores the key enterprises entering the MVNO market and launching mobile services via MVNO in a Box partners. It also provides forecasts for total MVNO revenue from mobile subscribers in 2030.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyTop 10 Emerging Tech Trends 2026

See which emerging technologies will shape enterprise strategy and investment in 2026; from post-quantum cryptography to neuromorphic computing and next-generation infrastructure.

VIEW -

WhitepaperDecember 2025Telecoms & Connectivity

WhitepaperDecember 2025Telecoms & ConnectivityHuman + AI: Drivers of Customer Experience AI Agents in 2026

Our complimentary whitepaper, Human + AI: Drivers of Customer Experience AI Agents in 2026, examines the key drivers of the AI agents for customer experience platforms market in 2025.

VIEW -

WhitepaperDecember 2025Fintech & Payments

WhitepaperDecember 2025Fintech & PaymentsBeyond Chargebacks: The True Cost of Fraud for Digital Commerce

Our complimentary whitepaper, Beyond Chargebacks: The True Cost of Fraud for Digital Commerce, examines the state of the eCommerce fraud prevention market; considering the impact of evolving digital fraud strategies, including key trends such as identity theft, account takeovers, chargebacks, policy abuse and friendly fraud.

VIEW -

WhitepaperNovember 2025Telecoms & Connectivity

WhitepaperNovember 2025Telecoms & ConnectivityeSIM-only Devices: The Impact on Operators, Consumers, and IoT

Our complimentary whitepaper, eSIM-only Devices: The Impact on Operators, Consumers, and IoT, explores the challenges and opportunities for the three segments, with a particular focus on eSIM-only smartphones and SGP.42.

VIEW

-

Fintech & Payments

Civic Identity Apps, Tokenisation, & AI to Revolutionise Fraud & Security Globally in 2026

January 2026 -

Telecoms & Connectivity

eSIM Connections to Reach 1.5bn Globally in 2026, But Platforms Must Adapt to Fuel Growing IoT Demand

January 2026 -

Fintech & Payments

Modern Card Issuing Platforms to Issue 1.6 Billion Payment Cards in 2030, as Banks Shift Focus From UX to Cost Efficiency

January 2026 -

IoT & Emerging Technology

Post-quantum Cryptography Market to Exceed $13 Billion by 2035 as Q-Day Awareness Accelerates

January 2026 -

Fintech & Payments

Digital Wallets: QR Codes to Constitute Half of All Wallet Transactions Globally Over Next Five Years

January 2026 -

Telecoms & Connectivity

MVNO in a Box Platforms to Drive MVNO Market to 438 Million Subscribers Globally by 2030

January 2026