Are Stablecoins Still Riding the Wave of the Future?

Over the past few years, digital currencies, and stablecoins more specifically, have been a high-profile topic within fintech & payments - being touted as the future of money on a regular basis.

As with any new development, there has been a significant amount of hype and noise around this, but until recently, little evidence of what impact stablecoins are actually having on the ground. However, the picture is now clearing up, with stablecoins having high potential across numerous areas. Indeed, stablecoins have hit a market cap of almost $280 billion as of August 2025; an increase of over $100 billion since the same point last year.

So what does this growth mean for the fintech and payments market? Stablecoins have broad potential, but examining use cases is important to understanding what this potential will look like on the ground.

Cross-border Payments

Cross-border transactions are the biggest potential area for stablecoin adoption, fundamentally because cross-border transactions are complex, costly and difficult to track under current models. Cross-border payments typically involve multiple layers of correspondent banks, meaning that to send money requires multiple stages, multiple parties receiving fees, and a costly FX conversion.

While newer players such as Wise and Revolut have been improving this by building more efficient networks, with Nium and Thunes targeting this market from an infrastructure angle, the market is still a complex one.

Stablecoins can have a major impact on this. As their value is set to a linked fiat currency, they have a set value, and critically can be sent and received across borders to different wallet addresses, regardless of physical location. This has the potential to unlock far cheaper and faster cross-border payments, and we expect this to have a major impact in markets such as remittances.

Programmable Money

One of the ideal scenarios for digital transformation of money is that it can become fully programmable. Under this scenario, a digital currency could be tied to whatever scenario is required using a smart contract. This would enable financial transactions to become a seamless, programmable layer, in the same way that many other components and APIs act.

While this has been attempted with some payment methods such as virtual cards, these have their limitations as they rely on card acceptance rails. Stablecoins can be seen as the future of programmable money – they have a set and predictable value, and can be integrated easily into digital processes. As such, they have strong potential for transformation.

Storing Value in Unstable Economies

Central to stablecoins is their stability and predictable value; particularly given the overwhelming majority of stablecoins in circulation are USD denominated. This creates opportunities for the use of stablecoins in economies where the currency is unstable.

For example, recent months have seen economic instability in Venezuela, where economic sanctions have contributed to a major economic issue, with the Venezuelan Bolivar declining by 73% versus the US dollar in the past year. As such, demand for US dollars in Venezuela has been high, but restrictions by the government have limited the ability for Venezuelans to access foreign currencies. As such, Venezuelan interest in stablecoins has spiked.

In scenarios such as this, broad access to stablecoins will allow users in disrupted economies to preserve their wealth when hyperinflation and economic issues emerge.

Why Stablecoins Aren't the Whole Solution

While as we have seen stablecoins are high impact, particularly across those three use cases, they are not the whole solution by themselves.

Stablecoins, similar to any other payment method, still need on and off ramps. As stablecoins are not ubiquitous and cannot be used for everyday transactions, there has to be a way for money to be added and withdrawn from stablecoin wallets. This creates the same network challenge as other payment methods, and means that institutions using stablecoins will need to partner to enable pay ins and pay outs. In the remittance example, it is no problem to send money to a relative in another country, but if they cannot access that money, it is useless to them.

Conclusion

It is clear that stablecoins have strong potential to transform the way payments work, however while great progress is being made, we are still in the early stages of that transformation. What we need to see is greater support and involvement from financial institutions in terms of providing access to and operationalising stablecoins, which will help to bridge the cryptocurrency and everyday finance worlds.

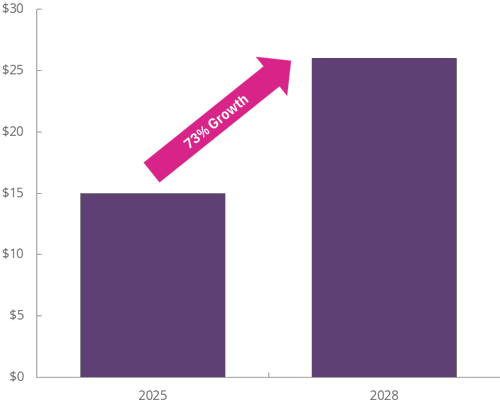

This is a process that is already starting to happen. Major financial institutions are starting to invest in stablecoin services, and indeed have already begun to use this for areas such as cross-border payments. This can be seen our latest data on the subject, which shows that financial institution savings are set to hit $26 billion in 2028 alone from stablecoin use.

Global Savings to Financial Institutions from Stablecoin Use ($bn), 2025 vs. 2028

Source: Juniper Research

As such, we expect financial institutions to increasingly engage with stablecoins. It will take time for stablecoins to touch different use cases, but we expect cross-border payments in particular to see strong disruption; transforming the way money is sent and received.

Nick Maynard is VP of Fintech Market Research at Juniper Research, where he leads analysis on key trends shaping the future of finance. With deep expertise across digital payments and commerce, his recent work includes reports on Chargeback Management, Digital Commerce, and Payment Card Technologies; helping stakeholders stay ahead in a rapidly evolving market.

Latest research, whitepapers & press releases

-

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW -

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030

ReportJanuary 2026Telecoms & ConnectivityMVNO in a Box Market: 2026-2030Juniper Research’s MVNO in a Box research suite provides Mobile Virtual Network Enablers, Mobile Virtual Network Aggregators, and other players with detailed analysis and strategic recommendations for monetising demand for MVNO in a Box services.

VIEW

-

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsThe Next Steps for Mobile Money – Interoperability and Openness

Our complimentary whitepaper, The Next Steps for Mobile Money – Interoperability and Openness, analyses how interoperability and open platforms can drive new growth opportunities through partnerships with key stakeholders.

VIEW -

WhitepaperJanuary 2026IoT & Emerging Technology

WhitepaperJanuary 2026IoT & Emerging TechnologyPreparing for Q-Day: Post-quantum Security Shift

Our complimentary whitepaper, Preparing for Q-Day: Post-quantum Security Shift, assesses the factors which are increasing interest in adopting PQC, and challenges to PQC adoption. Additionally, it includes a forecast summary of the global spend on PQC by 2035.

VIEW

-

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026 -

Fintech & Payments

KYC & KYB Systems Spend Outside Financial Sector to Grow 105% by 2030 Globally, as KYC Moves Beyond Banking

February 2026