Apple's Vision for RCS is Now Clearer: What to Expect

RCS has been hindered by a lack of support over iOS devices. However, in November 2023, Apple finally announced its plans to roll out RCS support in 2024. At the company’s WWDC event in June 2024, it provided more information on the integration of RCS into iMessage, including the support for the GSMA’s UP (Universal Profile). Read receipts, audio notes and high-quality media support will be implemented into iMessage.

The Impact of Apple’s RCS Support on the Mobile Messaging Market

RCS business messaging was first formed in 2007, and is a richer alternative to SMS. RCS allows users to send and receive rich media such as high-resolution images, videos and GIFs. Messages from brands are also verified. But what does this mean for the mobile messaging industry?

SMS has been the cornerstone of the business messaging market over the previous two decades. However, it continues to face pressures from alternative technologies and services, including RCS. As a result, our messaging research has shown that demand for SMS business messaging traffic is declining in many markets owing to high termination prices and high levels of fraud over SMS networks.

This leads to the potential for RCS messaging technology to cannibalise the established SMS traffic that has provided operators with over $50 billion in revenue globally in 2023. However, with this diminishing level of trust in SMS, and the now growing reach of RCS, it is imperative that operators expand their portfolio of messaging technologies to cover transactional and promotional use cases.

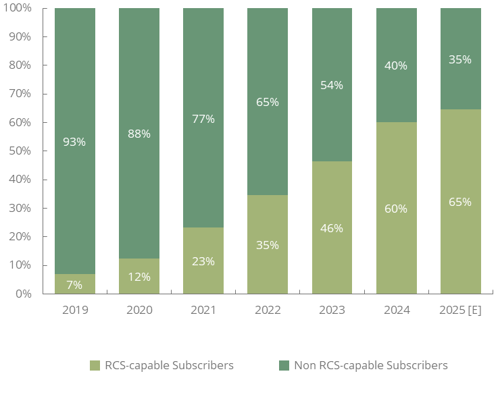

This expansion of reach can be seen in the below figure. Apple’s support of RCS will lead to the number of RCS-capable subscribers overtaking the number of non-capable subscribers for the first time. This provides a valuable proposition for enterprises looking to capitalise on both the reach and the rich media elements of the technology, and we expect promotional use cases, such as advertising and upselling, to be amongst the first use cases across various industries.

Global Proportion of Mobile Subscribers That Are RCS Capable (%), 2019-2025

Source: Juniper Research

Key Strategies for Attracting Clients to RCS

Whilst much of the media attention from WWDC 2024 has been focused on Apple Intelligence and the benefits to iOS and MacOS users, the key beneficiary of Apple’s RCS support will be B2C enterprises who leverage mobile messaging, and the operators who benefit from the increased revenue. But how do operators and messaging service providers maximise this revenue?

Juniper Research has identified several key technologies, their benefits, and strategies on how to increase their effectiveness. They are as follows:

- Brand Verification & Authentication: The implementation of conversational AI and eCommerce capabilities into the native messaging app will be instrumental in providing a highly valuable proposition for the retail sector. By 2028, our latest research predicted that over 35% of RCS business messaging traffic will be attributable to this sector, accounting for approximately 300 billion messages.

- Chatbot Integration & Conversational AI: With the rise of LLMs (Large Language Models), omnichannel communications approaches are more valuable to enterprises than ever. Indeed, Apple has partnered with OpenAI for its virtual voice assistants, and we expect vendors to expand on similar partnerships for conversational AI, an aspect that suits the rich media messaging capabilities of RCS messaging.

- Additional Security of RCS Messaging: Additionally, with the ever-expanding use cases of messaging over RCS messaging, security of content in transmission will remain of the utmost priority. Unlike SMS, RCS has end-to-end encryption, which will be vital in attracting potential users from the banking industry, including the TLS (Transport Layer Security), self-destructing messages and verified senders.

Operators must promote RCS basic messages, which have price parity with SMS, to encourage enterprise adoption of RCS. This will encourage enterprise users to explore the rich media messaging capabilities, and whilst operators benefit from the traffic, its will be CPaaS vendors and mobile messaging platforms that will provide the management tools.

For more insights on how messaging markets are evolving, visit our Mobile Messaging Market Intelligence Centre, where you can find studies including:

- Mobile Messaging: Our leading study into the mobile messaging market provides a comprehensive analysis of the messaging ecosystem. It includes an assessment of the challenges facing the market and in-depth strategic recommendations for key stakeholders, including mobile operators, messaging platform providers and OTT (Over the-Top) messaging application players. In addition, the report assesses 20 leading mobile messaging vendors in the latest iteration of the Juniper Research Competitor Leaderboard.

- RCS Business Messaging: This study is comprised of comprehensive assessment of the growing RCS market and its challenges; identifying key focus markets aligned with strategic recommendations and emerging opportunities for market stakeholders.

- A2P Messaging: Our A2P Messaging research suite provides a detailed and insightful analysis of this established market; highlighting key areas for innovation and future growth. This enables A2P messaging stakeholders to understand key trends within this competitive environment.

- CPaaS: Our latest CPaaS research provides a comprehensive assessment of this growing market, featuring a regional analysis and an evaluation of each of the channels that comprise CPaaS offerings, including email, MMS, chatbots, RCS, social media, SMS and voice services.

As VP of Telecoms Market Research at Juniper Research, Sam produces research on telecommunications technologies and the future of digital content - with recent reports covering CPaaS, 5G Satellite Networks, and Mobile Messaging. He has also been interviewed by leading media outlets, including the BBC and Wall Street Journal, and is a regular contributor to messaging conferences and telecommunications industry events.

Latest research, whitepapers & press releases

-

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030

ReportMarch 2026Fintech & PaymentsCross-border Payments Market: 2026-2030Our Cross-border Payments research suite provides a comprehensive and in-depth analysis of the evolving cross-border payments landscape; enabling stakeholders such as businesses, financial institutions, payment service providers, card networks, regulators, and technology infrastructure providers to understand future growth, key trends, and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityMobile Messaging Market: 2026-2030Juniper Research’s Mobile Messaging research suite provides mobile messaging vendors, mobile network operators, and enterprises with intelligence on how to capitalise on changing market dynamics within the mobile messaging market.

VIEW -

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030

ReportFebruary 2026Fintech & PaymentsKYC/KYB Systems Market: 2026-2030Our KYC/KYB Systems research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

VIEW -

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030

ReportFebruary 2026Telecoms & ConnectivityRCS for Business Market: 2026-2030Our comprehensive RCS for Business research suite provides an in‑depth evaluation of a market poised for rapid expansion over the next five years. It equips stakeholders with clear insight into the most significant opportunities emerging over the next two years.

VIEW -

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030

ReportFebruary 2026Fintech & PaymentsMobile Money in Emerging Markets: 2026-2030Our Mobile Money in Emerging Markets research report provides detailed evaluation and analysis of the ways in which the mobile financial services space is evolving and developing.

VIEW -

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035

ReportJanuary 2026IoT & Emerging TechnologyPost-quantum Cryptography Market: 2026-2035Juniper Research’s Post-quantum Cryptography (PQC) research suite provides a comprehensive and insightful analysis of this market; enabling stakeholders, including PQC-enabled platform providers, specialists, cybersecurity consultancies, and many others, to understand future growth, key trends, and the competitive environment.

VIEW

-

WhitepaperMarch 2026Telecoms & Connectivity

WhitepaperMarch 2026Telecoms & ConnectivityMWC 2026: What's Next for Mobile?

Our latest whitepaper distils the most important announcements from MWC Barcelona 2026 and examines what they mean for the telecoms market over the year ahead. From network APIs and 5G monetisation to AI-RAN, direct-to-cell connectivity, and 5G-Advanced, it explains where the biggest opportunities — and challenges — will emerge next.

VIEW -

WhitepaperMarch 2026Fintech & Payments

WhitepaperMarch 2026Fintech & PaymentsThe Transformation of Cross-border Payment Infrastructure

Our complimentary whitepaper, The Transformation of Cross-border Payment Infrastructure, examines the state of the cross-border payments market; explaining the role of key actors in transforming the cross-border payment experience, as well as the current landscape and recent developments within the cross-border payments industry.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityHow Social Media Will Disrupt Mobile Messaging Channels in 2026

Our complimentary whitepaper, How Social Media Will Disrupt Mobile Messaging Channels in 2026, explores the challenges and opportunities for operators and enterprises as social media traffic continues to increase.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & ConnectivityProtecting Users from Scam Ads: A Call for Social Media Platform Accountability

In this new whitepaper commissioned by Revolut, Juniper Research examines how scam advertising has become embedded across major social media platforms, quantifies the scale of user exposure and financial harm, and explains why current detection and enforcement measures are failing to keep pace.

VIEW -

WhitepaperFebruary 2026Fintech & Payments

WhitepaperFebruary 2026Fintech & PaymentsKnow Your Agents (KYA): The Next Frontier in KYC/KYB Systems

Our complimentary whitepaper, Know Your Agents (KYA): The Next Frontier in KYC/KYB Systems, examines the state of the KYC/KYB systems market; considering the impact of regulatory development, emerging risk factors such as identity enabled fraud, and how identity and business verification is evolving beyond traditional customer and merchant onboarding toward agent-level governance.

VIEW -

WhitepaperFebruary 2026Telecoms & Connectivity

WhitepaperFebruary 2026Telecoms & Connectivity3 Key Strategies for Capitalising on RCS Growth in 2026

Our complimentary whitepaper, 3 Key Strategies for Capitalising on RCS Growth in 2026, explores key trends shaping the RCS for Business market and outlines how mobile operators and platforms can accelerate adoption and maximise revenue over the next 12 months.

VIEW

-

Fintech & Payments

Top Three Global Leaders in Cross-border Payment Infrastructure Revealed

March 2026 -

Telecoms & Connectivity

MVNO Subscriber Revenue to Exceed $50 Billion Globally in 2030

March 2026 -

Fintech & Payments

QUBE Events is excited to bring back the 24th NextGen Payments & RegTech Forum - Switzerland

February 2026 -

Telecoms & Connectivity

OTT Messaging Apps to Exceed 5 Billion Users Globally by 2028; Driving Shift in Enterprise Communication Strategies

February 2026 -

Fintech & Payments

Calling All Fintech & Payment Innovators: Future Digital Awards Now Open for 2026

February 2026 -

Telecoms & Connectivity

Operator RCS for Business Revenue to Reach $3 Billion Globally by 2027, Growing 150% in Two Years

February 2026